Before we get started, I wanted to let you know the third episode of my new podcast Room to Run is live on Spotify and Apple Podcasts.

In this week’s episode we discussed:

How to profit from the AI race over the next five years (HINT: it’s not Nvidia)

Should you be concerned about Warren Buffett’s stock sales?

Is Nvidia (NVDA) a buy after earnings

Preview of next week’s market moving events

Each 10-minute episode can be listened to for FREE on Spotify and Apple Podcasts. If you enjoy the podcast, please leave a review.

What if I told you how to find the next Nvidia, Apple, or Google?

Well, the first thing you’d need to do is identify which market mega trends will define the next decade.

And a good place to start is to understand the mega trends that have shaped markets over the last 50 years.

The Mega Trends that Got Us Here

The last decade of stock market winners have been defined by US tech dominance.

The basket of stocks that typified this trend like Apple, Microsoft, Amazon, Meta, Google, and others have had names like FAANG and Mag7 over this period.

But it’s the mega trends behind these stocks that are the real story, including the growth in global smartphone adoption (i.e. the iPhone), the ubiquitousness of social media (i.e. Facebook, Instagram, YouTube), e-commerce demand (i.e. Amazon) and the growth in cloud computing platforms (i.e. Amazon, Google, Microsoft). That’s in addition to niche trends like blockchain technology, streaming, and the gig economy.

In the 1990s and 2000s, the mega trends that defined markets were the advent of the Internet and the personal computer, which set the groundwork for a revolution in communication and commerce. The rise of globalization also opened up new markets around the world.

In the 1970s and 1980s, a shift to industrial automation and widespread financial deregulation set the stage for what we think about today as global finance. The adoption of microprocessors during this time also paved the way for the digital revolution, enabling the rise of personal computing and laying the groundwork for the technology boom in the following decades.

There are clues as to what megatrends will define the next decade. By identifying what these trends are now, we can position ourselves to profit from them, much like how I bought Apple in 2015, Bitcoin and 2017, and Google in 2018.

Megatrend #1: The Digitization of Everything

Back in 2010, the amount of data created on the entire planet was 2 zettabytes.

To put that into perspective, that's enough storage to hold over 200 billion HD movies. But by 2020, this figure had jumped to 47 zetabytes thanks to the explosive growth of the internet, the proliferation of smart devices, social media, and the rise of Internet of Things.

But by 2035, the world is expected to generate nearly 2,200 zetabytes of data. That’s a massive increase, and it will drive innovation and investment in areas like cloud computing, artificial intelligence, and advanced analytics as the world becomes increasingly digitized and connected like never before.

That should benefit industries like data storage, cybersecurity, and telecommunications, which are crucial to managing and protecting this enormous volume of information.

Megatrend #2: Greying of the Developed World

Countries like the US, Europe, Japan, and China will see their populations decline over the next 50 years due to the rapid aging of the Baby Boom generation.

In the US alone, 10,000 baby boomers have been retiring every day since 2019. This will lead to a boom in spending, which makes sense as Baby Boomers in the US control $70 trillion in wealth, or 50% of all wealth in the country.

This generation is expected to spend an estimated $15 trillion of that money by 2030.

The healthcare sector will be a significant beneficiary, with spending on healthcare expected to grow from $3.6 trillion in 2020 to over $6 trillion by 2028. The financial services industry will also see growth as Baby Boomers seek to manage their wealth in retirement, with the retirement services market expected to exceed $1 trillion by 2030. Meanwhile, the travel industry is likely to see a surge as more Baby Boomers retire, with a projected $1.6 trillion in spending on travel and leisure by 2030.

Megatrend #3: Rise of the Millennials

Investment strategist Tom Lee has spoken at length about how he expects the S&P 500 to triple by 2030 because Millennials are entering their prime earnings years. This is a major economic tailwind for the US, as Millennials are the largest demographic cohort in the US. All millennials will be between the ages of 30 and 50 over the next decade, which is the time in your life when you make big life decisions like buying houses, cars, having children, etc. These are the types of transactions that really propel an economy.

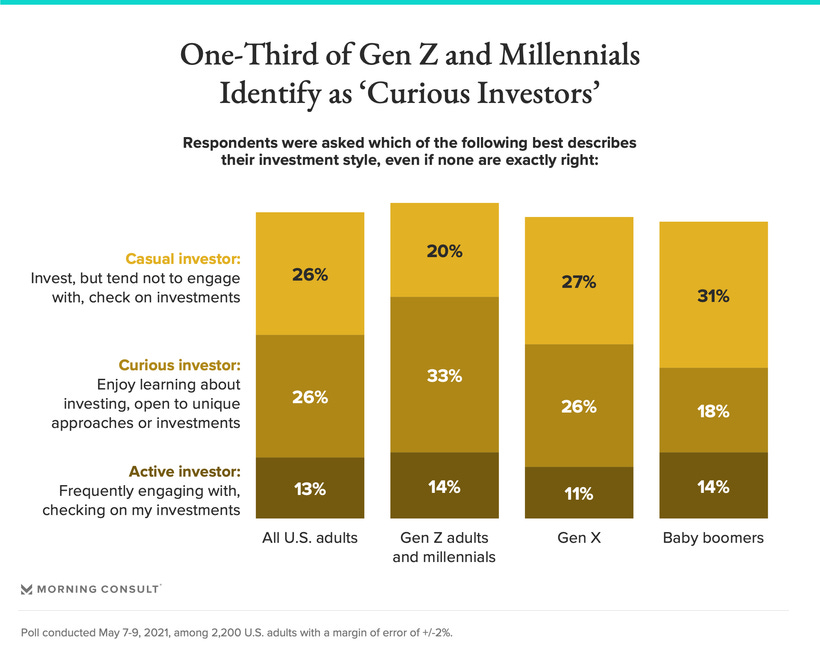

And that will be good for the stock market as a whole. At present, only 6.5% of Millennials’ assets are in stocks. That’s compared to 6.0% when the first Boomers turned 40.

But over the next 20 years, Boomers allocation to stocks grew to over 25%. If Millennials follow the same trajectory, they also will see their exposure to stocks grow. This will be enhanced by what’s known as the Great Wealth Transfer, where $85 trillion in assets will be transferred from Boomers to their children in the US alone by 2045, although that’s a topic for another podcast as it's more of a 20-year mega trend than a 10-year mega trend.

There are a few other mega trends on my radar like deglobalization, agricultural sustainability, and the biotech revolution, but we’ll cover those in a future episode of my Room to Run podcast (follow for free on Spotify and Apple).

Because if you can identify these mega trends early, you can also identify the stocks that will benefit from them. And that will allow you to make a lot of money.

If you want to see which stocks I’m personally holding to profit from these megatrends, you can join the 850+ investors in our community here.

Stay safe out there,

Robert