How Presidential Elections Affect the Stock Market

The market is telling you something...

Before we get started, I want to welcome the +39 subscribers who signed up for the Let’s Analyze newsletter in the last week! If you want to join our community, make sure to sign up here:

It’s impossible to escape politics in the US these days.

Whether it’s US government debt getting downgraded, a new indictment for former President Trump, or another illicit video from Hunter Biden, the political outrage machine, err, “news cycle” is seemingly nonstop.

That’s one reason I rarely talk about politics in these letters. While I hold my own personal political beliefs, I tune it all out when making investment decisions.

But occasionally there’s an overlap between politics and markets. And one of those instances is in the relationship between presidential election cycles and the stock market…

…which we’ll dig into today.

Everything is Going to the (Presidential) Plan

Stocks have been on a great run in 2023.

Optimism over AI, the side-stepping of a recession in the US, and falling inflation have catapulted the S&P 500 back near all-time highs:

But there’s been one other tailwind for the market this year: the Presidential Election Cycle Theory.

The Presidential Election Cycle Theory is a pattern that suggests there's a certain rhythm to how the stock market performs in relation to the four-year U.S. presidential election cycle.

And this year, the cycle is right on schedule.

A Brief Review of Presidential Cycles

The Presidential Election Cycle was developed by economist Yale Hirsch.

He developed and tested his theory by analyzing historical market data and presidential election cycles over 120 years.

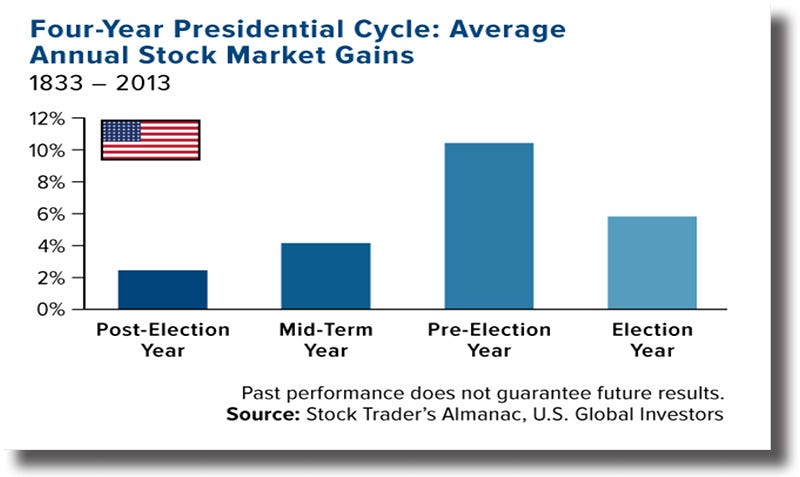

And his results were interesting. Here’s a quick breakdown:

Year 1 (Post-Election Year): After a presidential election, the first year tends to be a bit sluggish for the stock market. This is because the new president is just settling in and getting their plans in motion. On average, the S&P 500 has delivered modest gains in the range of 5-6% during this year.

Year 2 (Midterm Year): The second year, which is also a midterm election year, often sees a better performance. This is when the president and their party try to boost the economy to improve their chances in the upcoming midterms. The market tends to respond positively, with average gains of around 7-8%.

Year 3 (Pre-Election Year): This is when the stock market tends to really shine, as the president and their party are eager to show strong economic results before the next election. So, they push policies that could potentially give the market a boost, which is why Year 3 has seen some of the strongest gains with average returns of about 15%.

Year 4 (Election Year): In the election year itself, things can get a bit uncertain. The market might experience some ups and downs as investors worry about potential changes in leadership and policies. Despite the jitters, election years have still seen moderate gains on average, usually around 6-7%.

2023 falls on “Year 3” of the Presidential Election Cycle.

And so far, the S&P 500 is following the historical trend to a T.

The Most Profitable Part of the Cycle

The pre-election year is often considered the "sweet spot" in the Presidential Election Cycle Theory.

That’s because it’s the year where the stock market has historically experienced its strongest gains.

One of the main reasons for this phenomenon is that in the third and fourth year of a president's administration, the president begins to make laws tailored towards strengthening the economy.

This makes sense when you think about it. In the pre-election year, the incumbent president and their party are keenly aware that the next election is just around the corner. As a result, they may take actions and implement policies that aim to stimulate the economy and boost the stock market.

We’ve seen this in action, including the Inflation Reduction Act, the Chips Act, and even the Biden Administration’s attempt to cancel $20,000 in student loan debt.

These stimulus measures often put more money in the pockets of people and businesses. This then translates to higher earnings for many publicly traded companies.

And since earnings are the main driver of stock market gains, it’s why we often see stocks perform well in the year before a presidential election.

But if history is any guide…

…Stocks Likely Take a Breather Here

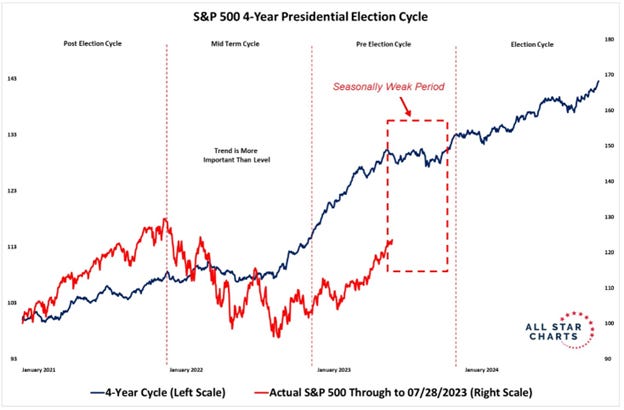

I mentioned on my Instagram channel that stocks will likely take a “breather” over the next three months.

This makes sense considering the S&P 500 is having an above average year, delivering a solid +17% gain this year…

…but also because we’re entering into a “seasonally weak” part of the Presidential Market Cycle:

But for those investors with a long-term time horizon, this can be a great period to add to your long-term positions.

Because as we’ve talked about multiple times, the way to make money in the stock market is to buy and hold quality businesses and hold their shares for many years.

And that’s exactly what I plan to keep doing.

Stay safe out there,

Robert