Before we get started, I wanted to let you know the new episode of my podcast Room to Run is live on Spotify and Apple Podcasts.

In this week’s episode we discussed:

Discover why the bull market isn’t over, despite recent volatility and fears.

Learn how upcoming Fed rate cuts could spark massive market growth.

My take on Elon Musk and the Department of Government Efficiency (DOGE)

Preview of next week’s market moving events

Each 10-minute episode can be listened to for FREE on Spotify and Apple Podcasts. If you enjoy the podcast, please leave a review.

The saying “hindsight is 2020” is common in investing.

It reflects how, with the benefit of time, the direction of the market often seems obvious, even though in the moment the trajectory is uncertain.

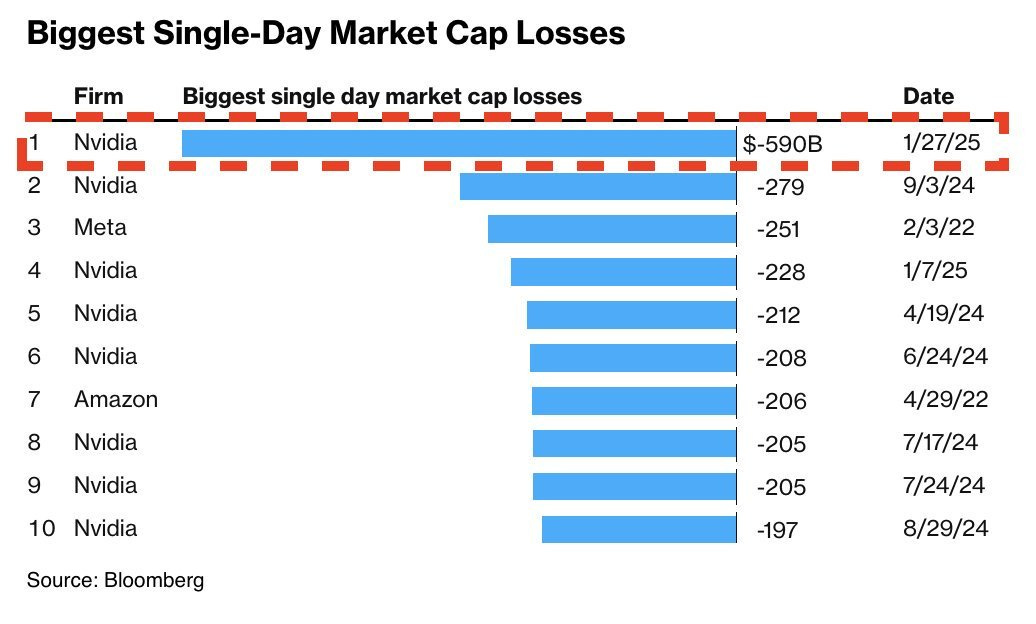

Take last month, for example. When China released its DeepSeek large language model, many—including myself at first—believed it would kill the bullish narrative for Nvidia and other AI winners. As a result, Nvidia lost $500 billion in market cap in a single day.

For perspective, there are only about 20 companies in the world with a valuation over $500 billion, so that’s a massive shift. Yet, what felt like an earth-shattering move at the time has since faded, and Nvidia is well on its way to recovery.

This is nothing new. In fact, this kind of market panic happens all the time.

A Walk Down Market Panic Memory Lane

Remember the yen carry trade sell-off in August? Investors feared the Bank of Japan would raise rates while the U.S. was cutting, threatening the longstanding carry trade.

As we know now, it didn’t blow up the market at all and instead turned into a fantastic buying opportunity for the TikStocks Portfolio.

We’ve seen this pattern throughout history: from the 2019 US-China trade war to Brexit, the European debt crisis, the BP oil spill, and even the Global Financial Crisis":

The “current things” roiling markets may feel catastrophic at the time, but with some perspective, many of them turn out to be mere bumps in the road as the market climbs the “Wall of Worry.”

Personally, I don’t waste much time focusing on these “current things.” When these events unfold, I focus on staying level-headed, managing risk, and sticking to my long-term investing principles. In volatile periods like these, having clear guiding principles is key to remaining unemotional.

The real question, however, is this: What will we look back on in 6-12 months and realize was obvious all along? As I assess the current market, here are my predictions for what will be clear hindsight in 2026.

1. The Bull Market Will Continue Through 2025

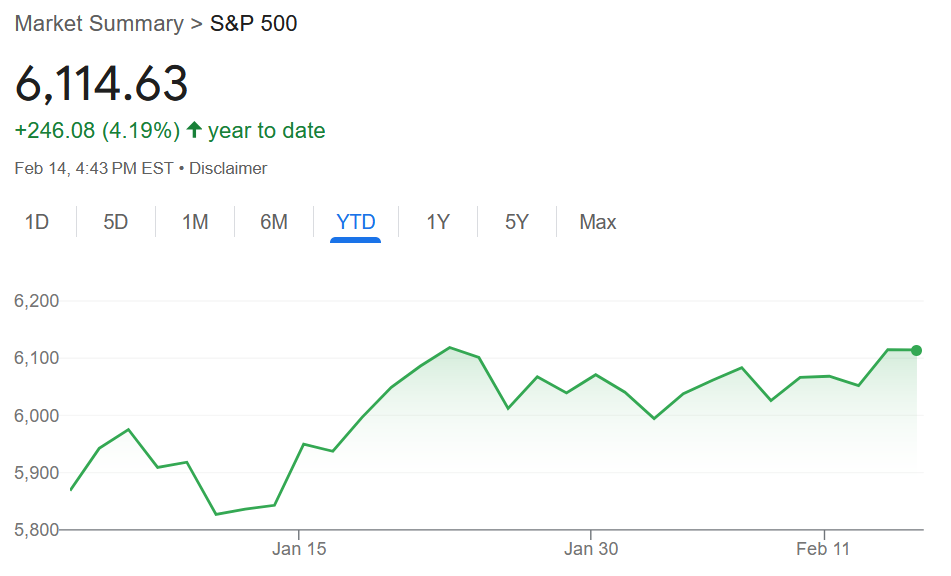

Despite the recent volatility with the DeepSeek release, Trump’s tariffs, and a hotter-than-expected inflation print, I believe the bull market is far from over. Over the past month, the market’s reaction to these events has been swift and telling—initial panic, followed by a quick recovery.

This is a market that, despite concerns, remains fundamentally strong, evidenced by the S&P 500 being up over 4% already in 2025:

Corporate earnings from the “Magnificent 7” tech stocks—Nvidia, Microsoft, Apple, and the others—have been robust, and as I mentioned in the TikStocks Portfolio Discord, the technical picture for these stocks is bullish.

Given the strength in earnings and the bullish technical indicators, it seems very likely that in hindsight, 2025 will be remembered as the year that the bull market continued to march on, and many investors will regret not buying the dips like we’ve been doing in the TikStocks Portfolio.

2. The Fed Will Begin Cutting Rates Again

Yes, the inflation data may seem alarming in the short term, but the market is telling us not to worry.

The recent inflation report that caused the S&P 500 to drop 1% was quickly reversed.

If you look at Truflation—an alternative inflation measure that’s been ahead of the curve for years—it forecasts inflation will hit just 2.0%, well below the official 3.0% number reported by the U.S. government. This discrepancy is due to seasonal factors, egg price fluctuations, and the front-running of Trump’s tariffs.

What’s most important here is that inflation fears are overblown. As the Fed recognizes this and we see signs of labor market weakness—possibly from AI displacement or cuts in public sector jobs due to new policies—the Fed will likely begin cutting rates again.

This is not priced in and could act as a huge upside catalyst for markets, further fueling the ongoing bull market. If I’m right, 2025 could be a year of major rate cuts and corresponding market gains.

3. Elon Musk’s Fiscal Cuts Will Be a Net Positive for the Market

Here’s a hot take: I actually think the fiscal cuts that Elon Musk and his supporters are pushing will be a net positive for markets.

Sure, many of his methods are unconventional (and at times controversial), but the reality is the U.S. government has had a spending problem for decades. The focus on slashing wasteful spending—particularly in the Pentagon, which has failed multiple audits and is rife with inefficiency—could ultimately benefit U.S. taxpayers and, by extension, U.S. markets.

The cuts to unnecessary government spending will be deflationary, which will lower bond yields and mortgage rates, ultimately reducing inflationary pressure. The U.S. market will benefit from lower borrowing costs, improving liquidity and making it easier for companies to invest, grow, and drive the economy forward.

While this may tick some people off, these fiscal cuts could provide the spark needed for the next leg of market growth.

Patience Pays Off

While the markets are facing a lot of uncertainty right now, one thing is clear: staying patient and sticking to fundamentals will pay off in the long run. Whether it’s the continuation of the bull market in 2025 and beyond, rate cuts providing a boost, or government fiscal changes leading to a healthier market, the future looks promising.

As always, my approach is to keep my eye on the long-term prize and ignore the noise in the short term.

If you have issues staying level-headed in volatile markets, I’d highly recommend joining the over 1,000 members in our TikStocks Portfolio community (click here to join).

If you stay disciplined and focused on the opportunities that will emerge in the coming months, you'll be well-positioned to capitalize on what’s next. In the world of investing, it’s not about predicting the future perfectly—it’s about making the right decisions when the time is right.

Stay safe out there,

Robert