Before we get started, I wanted to let you know the new episode of my podcast Room to Run is live on Spotify and Apple Podcasts.

In this week’s episode we discussed:

How your investing strategy should change now that the U.S. is bombing Iran

Three stocks and ETFs I’m buying on any market weakness

The dangers of buying into bearish narratives

Why shorting stocks is a horrible strategy

Each 10-minute episode can be listened to for FREE on Spotify and Apple Podcasts. If you enjoy the podcast, please leave a review.

Two years ago, I got food poisoning at a restaurant in Los Angeles.

It was one of the best meals I’ve had in LA. The service was great. The food was stellar (on the way down). But that one bad experience—probably from a raw oyster—completely erased all of that. I’ve never gone back, even though it’s ten minutes from my house.

Funny enough, that’s how most people invest.

They have one bad experience—buying at the top, holding too long, or watching their portfolio crater—and it colors how they view the market forever. They don’t just lose money… they build stories around that loss. Stories like:

“Tech is too risky.”

“I’ll buy back in when things calm down.”

“The Fed’s going to crash this market.”

I call this investor PTSD. And nearly everyone has it in some form.

And today, I’ll give you some tools to avoid - and potentially cure - your investing PTSD.

The Stories We Tell Ourselves

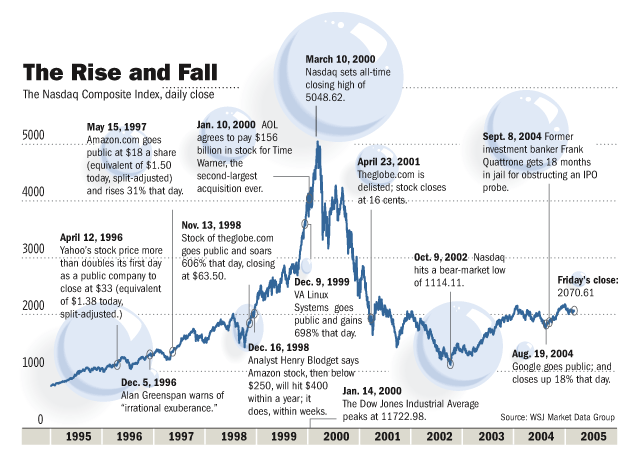

If you bought tech stocks in 1999, you probably watched the Dot-Com Bubble burst and told yourself, “Never again.” You may have reflexively avoided tech for the next 20 years—missing out on generational gains in Apple, Amazon, Google, and Nvidia.

If you started investing in 2008, you might still have a visceral reaction when markets drop 5%. Your brain goes right back to Lehman Brothers, and you sell first “just in case.”

Or maybe you entered crypto in 2021, right before the 2022 crash. You saw Bitcoin fall 75%, watched stablecoins implode, and told yourself, “This whole space is a scam.” So you stayed away—even as the sector matured and rallied again.

These are all stories we tell ourselves. But just because they feel true doesn’t mean they are true.

In fact, the real risk isn’t getting hurt again. The real risk is letting one bad experience rob you of years of opportunity.

So how do we fix that?

It starts with your mental diet.

Everyone Has Some Investing PTSD

What you consume shapes your outlook. If you’re constantly reading fear-driven headlines, following doomers on social media, and binging “crash is coming” TikToks… of course you’re going to feel anxious. And of course you’re going to second-guess every rally.

Case in point: my wife came home from work late the other night. She opened up TikTok to unwind and was hit with three videos in a row:

A woman claiming World War III was about to begin

A clip of ICE agents arresting people in the street

Footage of a massive underwater volcano supposedly “ready to blow”

That’s not a relaxing scroll. That’s a cortisol spike.

Now, I’m not saying these things don’t matter. But as someone who’s built a 500,000-person audience across finance social media, I can tell you firsthand: fear always goes viral. And social media algorithms reward the most sensational version of the truth.

So if you want to cure your investor PTSD, start by managing your mental inputs. Unfollow the doomers. Unsubscribe from the apocalypse newsletters. Click “not interested” on the fear-mongering creators.

Then, start zooming out.

The Math is On The Bulls’ Side

From 1926 to 2022, the U.S. stock market had positive annual returns in 76% of years. Bear markets? They’re the exception, not the rule. They last about one-third as long as bull markets. And after every major crisis—whether it was the Great Depression, 9/11, or COVID—the S&P 500 recovered and hit new highs.

Volatility is normal too. It doesn’t mean something is broken. Peter Lynch said it best: “The market climbs a wall of worry.” There will always be something to stress about—recessions, elections, wars. But if you react emotionally to every headline, you’ll always be behind the curve.

And lastly, take the politics out of it.

I don’t care who you’re voting for. Don’t let it dictate how you invest. Markets care about earnings and liquidity, not cable news soundbites. History shows there’s no meaningful difference in market returns between Republican and Democratic administrations. In fact, from 1945 to 2020, the S&P 500 delivered an average annual return of around 11%, regardless of which party held the White House.

So ask yourself: what story am I telling myself… and is it actually true?

You can’t change the past. But you can choose whether that bad experience becomes your identity—or just something you learn from.

Because just like I probably should give that restaurant another shot… you might need to give the market one too.

And if my thinking changes, you’ll be the first to know.

Stay safe out there,

Robert