Don’t Let This Mistake Ruin Your Portfolio

Some of you still don't understand how to make money in the markets...

Before we get started, I wanted to let you know the new episode of my podcast Room to Run is live on Spotify and Apple Podcasts.

In this week’s episode we discussed:

When you should take profits on your crypto holdings

How you should invest during crypto’s “alt season”

Preview of this week’s market moving events

Each 10-minute episode can be listened to for FREE on Spotify and Apple Podcasts. If you enjoy the podcast, please leave a review.

After this month’s rally, the TikStocks Portfolio is up +47% year-to-date—crushing the S&P 500’s +27% return over the same period.

While this is reason to celebrate, it’s also the perfect time to revisit a core principle of my strategy: be bullish when everyone is bearish and cautious when everyone is bullish. This “sentiment fading” strategy has made me hundreds of thousands of dollars for myself and millions for our TikStocks community members in the last year.

It seems like a concept that should be intuitive to most investors. But based on many of the responses to last week’s newsletter, some of you still don’t understand this.

Putting the Crypto Rally into Context

In April 2023, I told you the crypto bear market was ending, and we were entering a new cycle.

That call wasn’t popular. Crypto was “dead.” Sentiment was in the gutter. But Bitcoin is now up over +230% since then, proving that the best opportunities come when everyone else has given up.

Now, I’m calling the current bull run “late cycle.” And just like in early 2023, I’ve received a wave of criticism.

Some argue we’re entering a “super cycle,” fueled by a pro-crypto administration. Others claim the Strategic Bitcoin Reserve plan will pump Bitcoin into the stratosphere.

I don’t deny these are tailwinds, but here’s what these critics miss: markets are forward-looking.

The Problem With Late Longs

Longtime crypto investors are rightfully excited about the incoming Trump Administration.

There are rumors the new government will make the following pro-crypto moves:

Eliminating capital gains taxes on cryptocurrency holdings created in the US

Adding pro-crypto members to the cabinet (e.g. Howard Lutnick)

Potential creation of a strategic Bitcoin reserve for the United States that buys 100,000 Bitcoin per year for five years

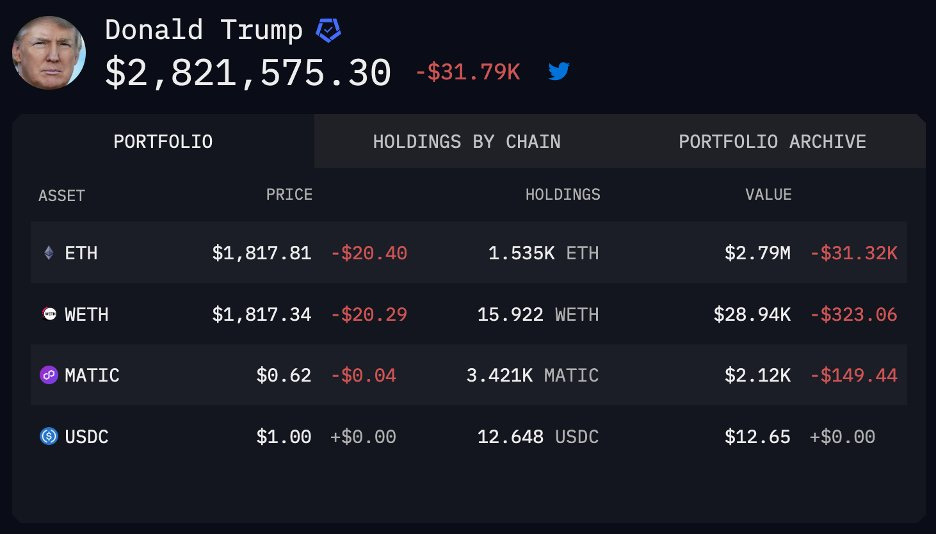

It’s also been disclosed that president-elect Trump personally owns millions of dollars worth of crypto:

All of this is bullish for crypto. But all of it is also now known to the public and talking about it. The market has already started to price-in the possibility that these initiatives will come to pass.

The Bitcoin rally after the election wasn’t an accident—it was the result of investors anticipating these policy shifts. If you were buying Bitcoin last year, like me and the TikStocks community, you were ahead of the curve. But if you’re only buying now, you’re what I call a “late long.”

Late longs tend to get punished because they’re chasing euphoria, not alpha. The alpha is in taking positions when there’s uncertainty, like when Bitcoin was stuck in the $20,000 range, and nobody wanted to talk about crypto.

Now that Bitcoin is at all-time highs, even Dave Portnoy is crying on Twitter about missing out, and every influencer is launching their own memecoin.

Why I’m Still Bullish—for Now

To be clear, I’m not saying the cycle is over. My indicators, like the Net Unrealized Profit and Loss (NUPL), suggest we’re in late cycle, not the end.

Historically, NUPL peaks when 75% of Bitcoin holders are in profit. Today, it’s at 62%, which means there’s likely room for more gains. Google searches for “Bitcoin” are spiking, and sentiment is euphoric, but we’re not at the blow-off top—yet.

This is the “greed” phase of the cycle, and it’s often the most profitable leg. But it’s also when you need to be the most disciplined. Every crypto position I add now is a rental, not a long-term investment. That includes the altcoin we bought last week that has already surged +17% (see my crypto portfolio here).

History shows most altcoins drop 90% or more in a bear market, so my strategy is to get in, ride the wave, and get out before the music stops.

How Sentiment Trading Works

Some of you still question my sentiment-driven approach.

The truth is, this strategy is uncomfortable because it often goes against the grain. In 2023, people didn’t want to hear about crypto during the bear market. Now, they don’t want to hear me say it’s time for caution. That’s the nature of contrarian investing.

Maybe I’m wrong, and this time really is different. Maybe we’re in a “super cycle,” and crypto will keep climbing indefinitely.

But that’s not how I see it. I believe this bull market will peak in the next 6-12 months, followed by the usual massive flush. However, I’ll keep an open mind. If my indicators change, you’ll be the first to know.

For now, the best thing you can do is stick to your plan. Don’t let euphoria cloud your judgment, and don’t chase late.

If you’ve been following the TikStocks Portfolio, you’re already in a great position to capitalize on this market. Let’s keep making smart, calculated moves and finish the year strong.

Stay safe out there,

Robert