Before we get started, I wanted to let you know the new episode of my podcast Room to Run is live on Spotify and Apple Podcasts.

In this week’s episode we discussed:

Is the US on the brink of recession?

How to manage your portfolio with stocks at all-time highs

Preview of next week’s market moving events

Each 10-minute episode can be listened to for FREE on Spotify and Apple Podcasts. If you enjoy the podcast, please leave a review.

A common myth among newer investors is that buying at all-time highs is a bad move.

And I get it; it feels counterintuitive to buy when prices have never been higher. But the reality might surprise you.

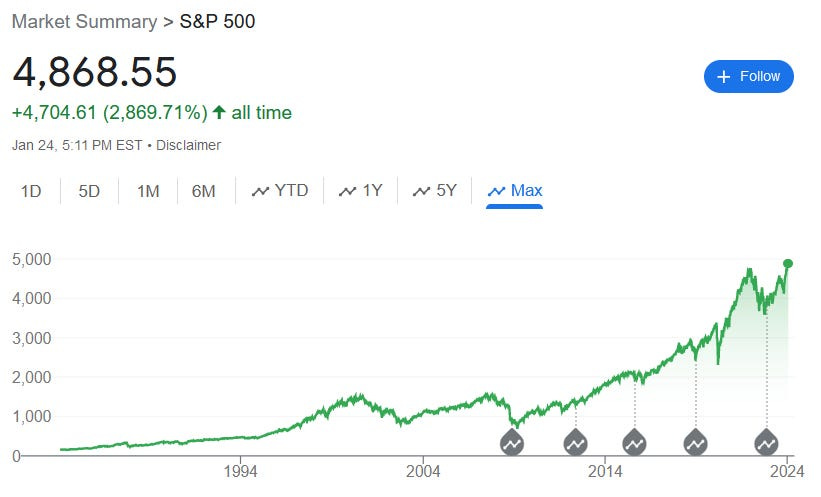

The fact is stocks reaching all-time highs is not as rare as you might think. In fact, since 1970, the S&P 500 has hit a new all-time high roughly every 16 days on average. That’s because, over time, markets tend to move upward due to growth in the economy, innovation, and increasing corporate profits.

But here’s the kicker: not only is it not bad to buy at all-time highs—it’s actually a great time to invest.

All-Time Highs: A Signal of Strength

Most investors know the S&P 500 returns about 10% annually on average.

But here’s the twist—when you invest at all-time highs, that average return is even better, clocking in at 11%.

The reason is simple: stocks spend far more time in bull markets than bear markets.

If you could go back to 2013, would you hesitate to invest because stocks were at an all-time high? Probably not, since the market has surged over +274% since then.

How about August 2020? Another all-time high, yet investing then would have netted you a +44% return, even after enduring one of the worst bear markets in recent memory.

All-time highs often signal that markets are in a healthy, upward trend, and jumping in at those moments has proven to be a winning strategy more often than not.

How I’m Navigating This Market

So, how am I approaching the market now that we’re at all-time highs? Here’s my strategy:

Index Funds: These are a cornerstone of my portfolio because they provide exposure to the entire market. Even at highs, you’re riding the wave of overall growth.

Individual Stocks: I’m always on the lookout for individual companies that have strong fundamentals and growth potential. Even in a high market, there are always undervalued opportunities if you know where to look.

Crypto: While more volatile, I keep a measured position in crypto for its potential to diversify and deliver high returns outside of traditional markets.

And if you’re going to individual stock route, there’s one I’ve been buying in my own portfolio (you can see my entire portfolio and real-time trades here) and one I’d avoid.

The one I’d buy is Nvidia (NVDA). The fundamentals and technicals for Nvidia still look as compelling as they did when I rated the stock a buy in February’s free Let’s Analyze newsletter before it surged another +70%.

This wasn’t the first time I’d recommended Nvidia was a buy. In fact, I listed Nvidia as one of my top five stocks to hold for the next five years in 2022 (you can read the original recommendation here).

Considering Nvidia has a monopoly on the building blocks of AI, is trading at a reasonable 29.8-times forward earnings, and remains in a technical uptrend, the stock is still a compelling buy.

However, one I’m a bit nervous about at present is Tesla (TSLA). While the stock has broken back above the 200-day MA - a bullish technical signal - the stock has the weakest technical picture amongst the major US tech stocks.

Personally, I only buy stocks in technical uptrends, which is typified by an upward sloping 200-day MA (red line). While every other Magnificent 7 tech stock currently checks this box, Tesla does not.

So for now, I’d avoid in in favor of Nvidia or any other Magnificent 7 tech stock.

The Long-Term Approach

The key to navigating markets at all-time highs is to focus on the long term. Markets have historically moved up over time, and while there may be short-term dips after an all-time high, the overall trend is upward. Trying to time the perfect moment to buy often means missing out on future gains.

Don’t let the fear of buying at the top stop you from taking advantage of the long-term growth potential that the stock market offers.

In the end, history shows that buying at all-time highs isn’t a bad move—it’s just part of the natural market cycle.

Stay invested, stay smart, and keep a long-term view.

Stay safe out there,

Robert