Don’t Confuse a Pullback with a Peak

We're in a bull market so start acting like it...

Before we get started, I wanted to let you know the new episode of my podcast Room to Run is live on Spotify and Apple Podcasts.

In this week’s episode we discussed:

Review portfolio changes I made during this week’s pullback

Exploring whether OpenAI is “too big to fail”

Scenarios for how the AI boom will end

Updating listeners on my market outlook

Each 10-minute episode can be listened to for FREE on Spotify and Apple Podcasts. If you enjoy the podcast, please leave a review.

Remember when I said the moment we saw any market weakness, the doomers would come out screaming “It’s the top! Sell everything!”?

Well… here we are.

The S&P 500 is down just 3% from all-time highs. The Nasdaq is down 4%. And yet, judging by the tone online, you’d think the entire market was collapsing.

To be fair, there are a few legitimate reasons for the sell-off:

The Supreme Court’s review of Trump’s tariff policy could result in the U.S. refunding over $1 trillion in tariff revenues leading to a potential fiscal shock

Nvidia’s Jensen Huang just made headlines saying China could beat the U.S. in AI, sparking fears about America’s tech edge

The worst October for layoffs since 2003 is stoking new labor market concerns

And finally, Jerome Powell hinted at a rate pause which spooked investors hoping for faster cuts.

But all that said, let’s take a step back. Since the April lows, the S&P is still up +34% and the Nasdaq +47%. That’s one of the strongest six-month stretches in history.

And looking even more near-term, the S&P 500 is flat over the last month.

If I were being nice, I’d tell you stocks don’t move in straight lines. They never have.

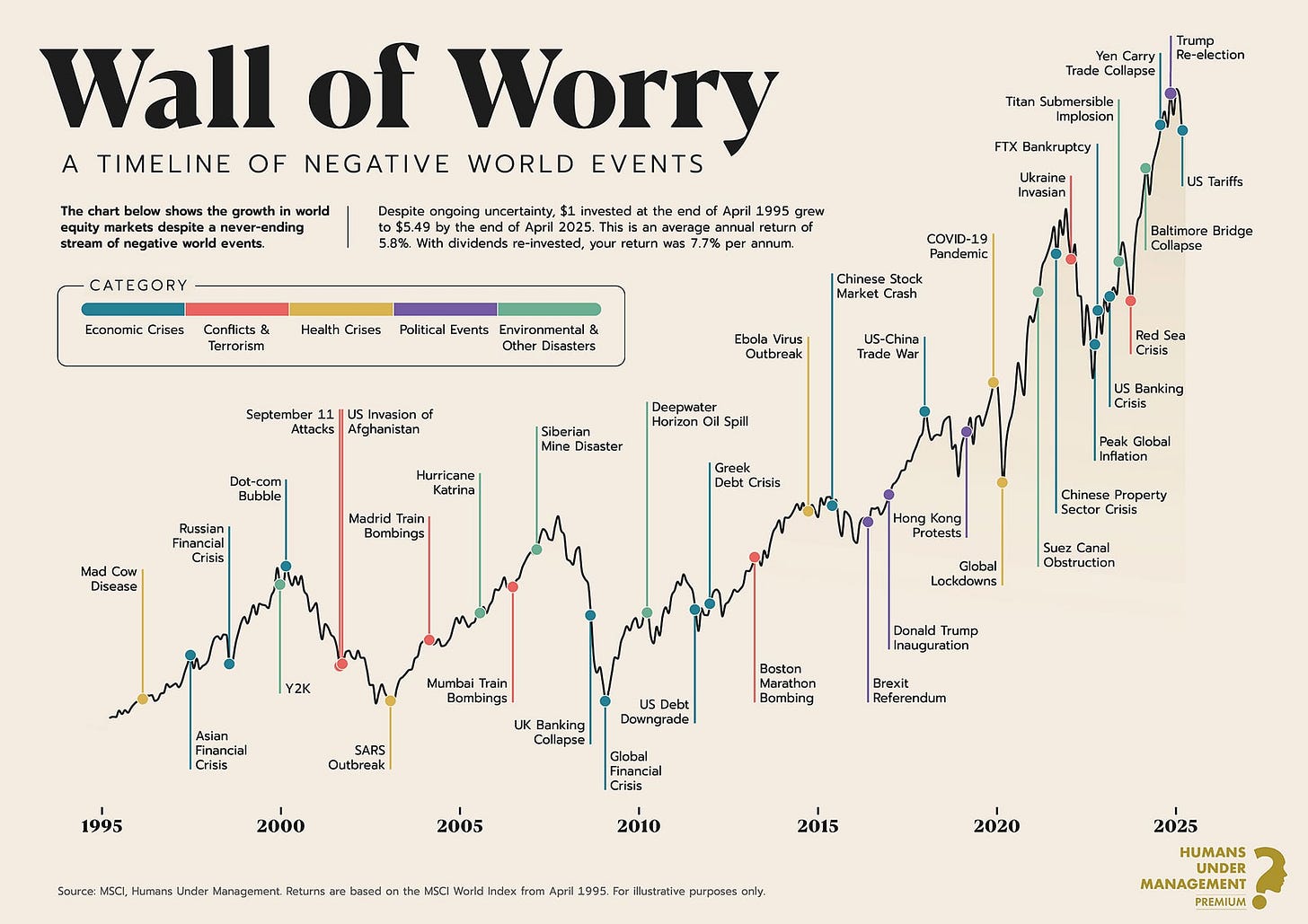

And if I’m being real, I’d say anyone panicking over the latest market weakness needs to grow a pair. There’s always something to worry about, but the market climbs a wall of worry for a reason:

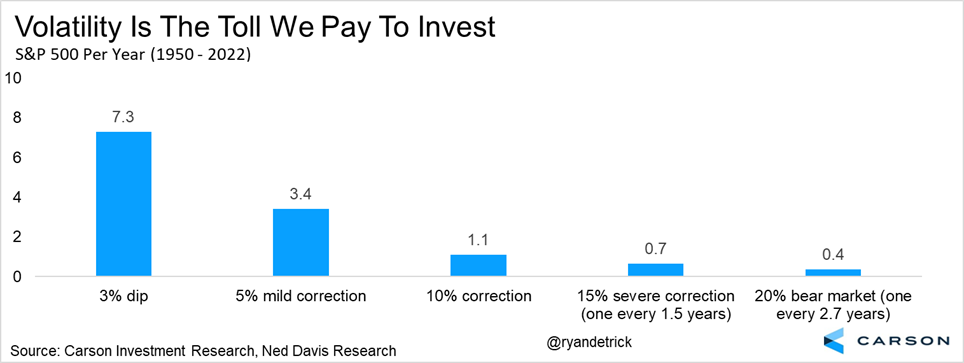

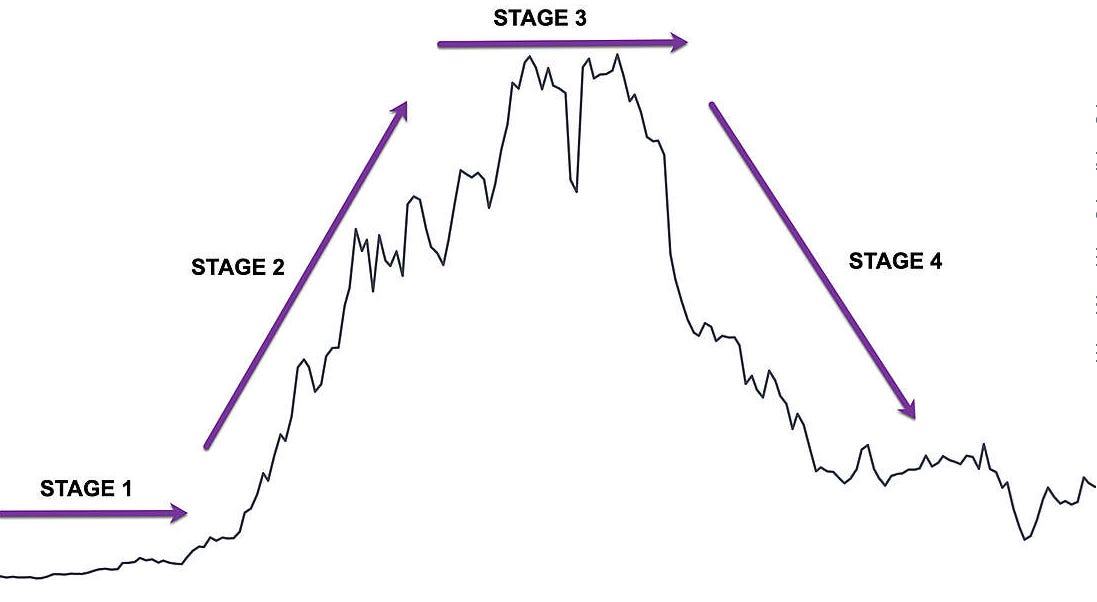

Plus, pullbacks aren’t crashes. They’re how markets breathe.

And if you study history, they are 100% normal.

This Is Not the End of the World

Since 1928, the S&P 500 has averaged seven 3% pullbacks and three 5% corrections every single year.

So far in 2025, we’ve had six 3% pullbacks. In other words: this is completely normal.

What we’re seeing now isn’t a top… it’s a digestion of one of the greatest runs in stock market history (which anyone reading this newsletter should have nailed as we’ve stayed bullish since the April lows).

The fact is, after months of relentless gains, the market is catching its breath.

Corrections clear out excess leverage, shake off the hot money, and set the stage for the next move higher.

It’s what keeps bull markets healthy.

It’s All About the Process

Now, I’ll be the first to admit: I’ve had a few misses.

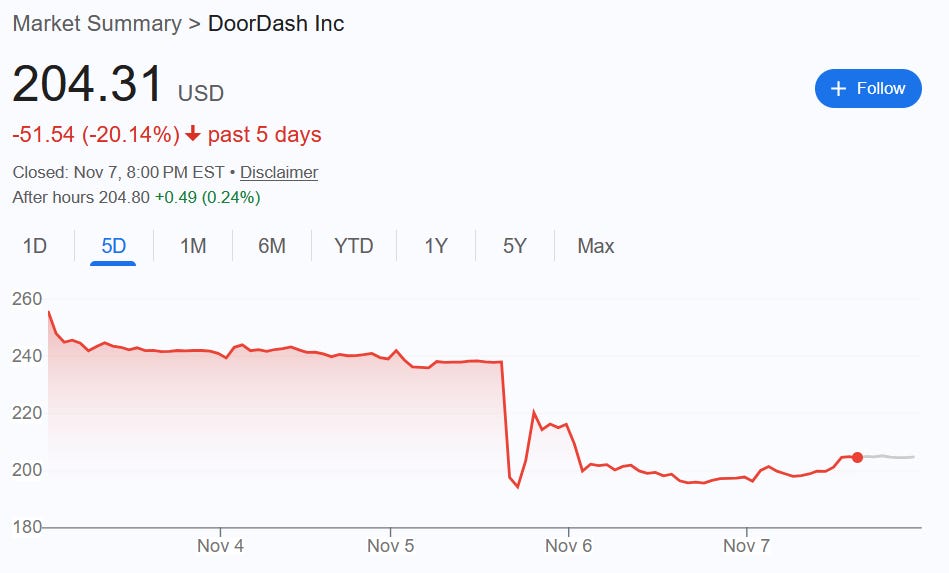

A few of our high-beta trading positions took it on the chin this week and hit their protective stop losses. That includes DoorDash (DASH) which tanked after an earnings miss, triggered our protective stop loss and selling for a -10% loss:

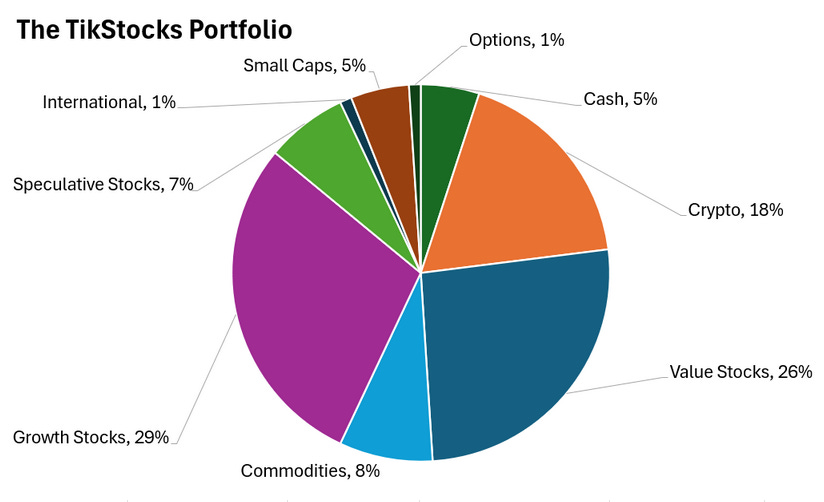

But while it’s no fun losing money, these risky high-beta positions made up a mere 3% of the TikStocks Portfolio.

Losses are never fun. But any losses taken this week were small, controlled, and part of a disciplined process. That’s risk management in action.

On the other hand, our core positions (e.g. index funds, Bitcoin, gold, and mega cap tech stocks) — make up roughly 70% of the total portfolio. They’re all performing incredibly well and sitting near all-time highs.

The TikStocks Portfolio as a whole reflects that same strength as it’s only a few points off all-time highs.

Could I have managed a few trades better? Sure. But nobody bats 1.000. Even Steve Cohen, one of the greatest hedge fund managers alive, only expects his PMs to be right about 55% of the time.

The goal isn’t perfection — it’s taking calculated risks when the fundamentals, technicals, and sentiment align.

And from what I’m seeing, the big picture still looks great.

The Big Picture Remains Bullish

Step back and look at the macro backdrop for a second.

We’ve got:

Rate cuts underway

Tax cuts stimulating corporate profits

Record AI capex spending from companies like Nvidia, Amazon, and Microsoft

Government stimulus and deregulation boosting growth

Plus, it looks like the government shutdown is ending…

…while President Trump revealed his plan for $2,000 “tariff checks” and 50-year mortgages over the weeks.

As I talked about on last week’s podcast, the US government is “running it hot” with these stimulus wave policies.

And while the Federal Reserve is hinting at a potential pause at the December meeting, that only delays the inevitable. The fact is Trump is getting his guy in at the Fed in May 2026... ~ 6 months from now. That person is going to cut rates like they’re going out of style the moment they’re sworn in.

And even with the backdrop laid out above, this is not a recessionary setup. It’s the opposite. It’s an environment designed to support risk assets.

Ride the Middle — Don’t Chase the Top

Could we get a 5% or even 10% pullback? Absolutely.

That’s not a crash — that’s a buying opportunity. The broader trend remains intact, and until we see a technical breakdown (like the S&P 500 closing below its 200-day moving average), the path of least resistance remains higher.

The fact is we’ve had an incredible run since spring. Now, the market’s giving us a short breather — a chance to regroup, re-evaluate, and refocus.

This is when serious investors separate themselves from tourists.

Because while the doomers are screaming “bubble” and “top,” we’re identifying new market leaders. We’re looking at sectors benefiting most from the Stimulus Wave, the ongoing AI infrastructure buildout, and the global liquidity surge that’s still picking up steam.

That’s where the next big moves will come from.

I’m always open to the idea I’m wrong. And if the technicals breakdown further, I will switch my approach. But everything I’m seeing points to this being just another pullback in what’s still shaping up to be one of the greatest bull markets of our lifetime.

Now is not the time to get bearish. It’s the time to get focused.

And that’s exactly what I’m doing — finding the next wave of leaders before everyone else realizes this run is far from over.

Stay safe out there,

Robert

The historical data on pullbacks is spot on. Looking at BULL specifically, these kinds of healthy pullbacks in a strong uptrend are exactly when you want to be adding to positionsrather than panicking. The broader market structure supports your thesis about this being far from a top.