Before we get started, I want to welcome the +45 subscribers who signed up for the “Let’s Analyze” newsletter in the last week! If you want to join our community, make sure to sign up here:

Most new investors are obsessed with picking bottoms.

For instance, we can look at a popular retail stock like Intel (INTC). The technology company has wildly underperformed the tech-heavyNasdaq index for years.

Yet, for some reason, every few months I get a Patreon Portfolio member asking me whether I think it’s a good buy:

And my response is always the same: picking bottoms is overrated.

Buying a stock because it’s down is a bad strategy because it often ignores the underlying reasons for the decline. The stock could be facing significant financial issues, declining market share, or broader industry challenges that might not be resolved quickly.

Now I know this might sound crazy to some of you. But instead of picking bottoms, you should buy stocks at all-time highs.

How I Learned to Stop Worrying and Buy All-Time Highs

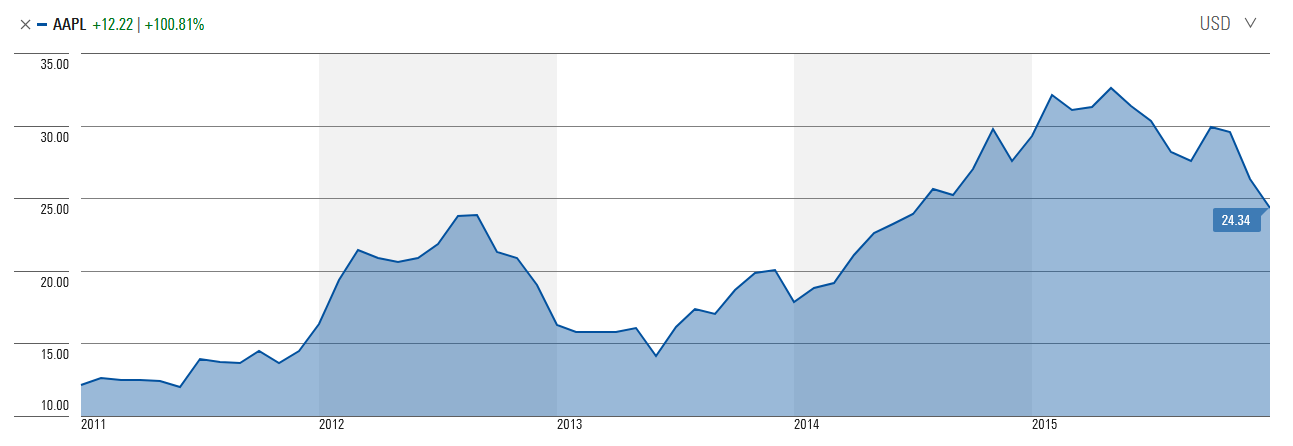

Back in January 2016, I opened a position in Apple (AAPL).

As of this writing, my position is +650%. That’s a great investment by most standards.

But at the time, I had trepidations about buying the stock because shares were near all-time highs…

…not to mention the stock had more than doubled over the previous five years. But while the stock had been on such a great run and still near the highs, I took the plunge and opened my position.

And then something amazing happened; the stock kept going up. And up. And up some more. After a few years, my entry point was just a blip on the chart:

This was one of many times since I’ve bought stocks at all-time highs with highly profitable results.

And I’ll tell you about a mote recently example now.

One Of My Best Traders of 2023

Back in August 2023, I opened a position in data analytics company Fair Isaac Corp. (FICO).

After conducting my normal analysis and sending the trade alert to my 800+ Patreon Portfolio members (you can read the original recommendation for free here), many people were apprehensive because FICO 0.00%↑ shares were trading at all-time highs:

However, to the surprise of many, I made the point that I much prefer to buy stocks at all-time highs than all-time lows. In fact, there is data to support that buying stocks near all-time highs is better than buying at all-time lows.

According to a study by Crandall, Pierce & Company, stocks that hit new highs are more likely to continue their upward trajectory compared to those hitting new lows, which often continue to underperform.

Additionally, research from the National Bureau of Economic Research (NBER) suggests that stocks reaching new highs tend to have better momentum and stronger performance in the subsequent periods than those trading at their lows.

This is supported by a study published in the Journal of Financial Economics, which found that stocks with strong momentum—often reflected by hitting new highs—tend to outperform in the near term, making them a more attractive buy than those at all-time lows.

And that’s exactly what happened with $FICO, as the stock continued its upward trajectory and has earned a +62% gain in the six months since we opened the position:

Not to pick on Intel (INTC) holders, but that stock - which was near all-time lows at the time I bought FICO 0.00%↑ - is actually down -12% over the same period…

…wildly underperforming the Nasdaq gain of 23% over the same period.

Do Not Fear All-Time Highs

The lesson here is clear: buying stocks at all-time highs is not something to fear but rather an opportunity to capitalize on strong momentum and proven performance.

As demonstrated by my experiences with Apple (AAPL) and Fair Isaac Corp. (FICO), stocks that are already on a winning streak often continue to climb, providing substantial returns for investors.

Conversely, trying to pick bottoms, as evidenced by Intel (INTC)'s ongoing struggles, can lead to disappointing results. By focusing on stocks that are hitting new highs, you can position yourself to benefit from the upward trends and the underlying strength driving those gains.

So, next time you see a stock near its all-time high, don't hesitate—consider it a potential winning investment. Stay focused on the long-term and keep leveraging the power of momentum in your investment strategy.

Stay safe out there,

Robert