Before we get started, I wanted to let you know the third episode of my new podcast Room to Run is live on Spotify and Apple Podcasts.

In this week’s episode we discussed:

How markets will likely react to the shooting of former President Trump

How one hedge fund manager predicted the Dot Com Crash in 2000

Is PayPal (PYPL) a buy?

Each 10 minute episode can be listened to for FREE on Spotify and Apple. If you enjoy the podcast, please leave a review.

You’re all reading this because you want to make money.

But when it comes to investing, making money should actually not be your top priority.

In fact, you goal from the get-go should be to not lose money…

…because if you do that, the upside typically takes care of itself.

The Virtues of Minimizing Losses

Every great investor talks about keeping losses small.

Warren Buffett famously said…

Billionaire hedge fund manager Paul Tudor Jones said…

And one of my personal favorites, Jeff Saut, recently said in his newsletter…

“Over my 50+ years in this business, and longer than that of buying stocks, the most important thing you can do is limit your losses.”

Everyone wants to focus on how to make money and get that “home run” trade.

But especially for new investors, your focus should be on not losing money.

As the math is not in the loser’s favor.

Keeping the Math on Your Side

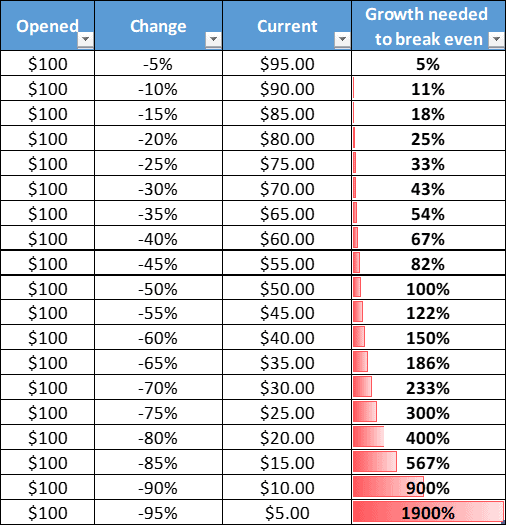

The table below shows that the more your losses increase, the gains required to breakeven increase exponentially…

…And the math gets less favorable the more you lose.

For example, if a position in your portfolio falls by 50%, that position needs to rise 100% just to breakeven. And if a portfolio position falls 90%, you need to make a 900% gain just to get back to even.

This is why minimizing losses is so important. Personally, if I have a trading position, I’ll sell it automatically if it falls -15% or more and reallocate elsewhere.

Because f you can avoid big losses, you can avoid the need for big gains just to breakeven.

But there’s actually a psychological reason why people don’t do this.

Don’t Fall Into this Investing Trap

There is a common behavioral finance trap many new investors fall into called the disposition effect.

The disposition effect is when investors are reluctant to sell stocks that are down but more likely to sell stocks that have gone up.

Let’s say you bought two stocks: Microsoft (MSFT) and Alibaba (BABA). Your Microsoft stock rises 31% and your Alibaba shares fall -16%. What would you do in this situation?

Many people would take their 31% gain on Microsoft – a solid, blue-chip stock – to “buy the dip” on Alibaba.

Well, I hate to tell you, but you’re almost always better off taking the -15% loss and buying more Microsoft shares – even though you’ll be buying at higher prices.

More often than not, you're better off selling your losing positions and reallocating that capital into your winners.

This counterintuitive strategy is effective because winning stocks often continue to win due to strong fundamentals or favorable market conditions, while losing stocks may continue to underperform.

A Word to the Wise

While it seems illogical, it has deep roots in human nature: people enjoy winning and hate losing. Nobody wants to take a loss, especially if there’s a “prospect” the stock could bounce back in the future.

It’s a hard lesson to learn, but you don't do yourself any favors by hanging onto losing positions.

And when I see people in our investing community doing this, I often send them this quote from Peter Lynch:

Holding losing positions you’ve lost faith in hoping they will “bounce back” is a recipe for disaster. You have to be hard on your losers, which is why I have a rule to cut any position that falls 25% or more.

Because the more you let the position fall, the more unlikely it is to hit a new high.

Instead of succumbing to the disposition effect, the best thing to do is cut your position and move on.

So don’t forget rule #1: don’t lose money. And if you do, don’t fall under the spell of the disposition effect.

Stay safe out there,

Robert