Before we get started, I wanted to let you know the second episode of my new podcast Room to Run is live on Spotify and Apple Podcasts.

In this week’s episode we discussed:

How changing US demographics affect the stock market

The biggest risk facing the current US bull market

Whether it’s time to buy the dip on Bitcoin

Each 10 minute episode can be listened to for FREE on Spotify and Apple. If you enjoy the podcast, please leave a review.

Can the world’s largest stock market triple in the next six years?

Investor Tom Lee thinks so. Tom is the head of Fundstrat, an independent investment research firm, and a frequent guest on CNBC.

He thinks the S&P 500 can rise to 15,000 by 2030. Considering the index is currently trading at 5,500, that is a near tripling of the main US stock index in under six years.

To put that in perspective, that means if you have $10,000 invested in an S&P 500 index fund, Tom thinks that will be worth roughly $30,000 in 6 years, which is a pretty drastic move higher.

While it’s a lofty projection, Tom believes changing US demographics, a global labor shortage, and the rise of AI will be the main drivers of these gains.

And there’s a good amount of data to support this outlook.

Demographics are Destiny

There’s a saying in economics that goes, “demographics are destiny.”

This means the size and composition of a country’s population can significantly impact economic growth, corporate earnings, and thus the stock market since stocks are priced based on earnings.

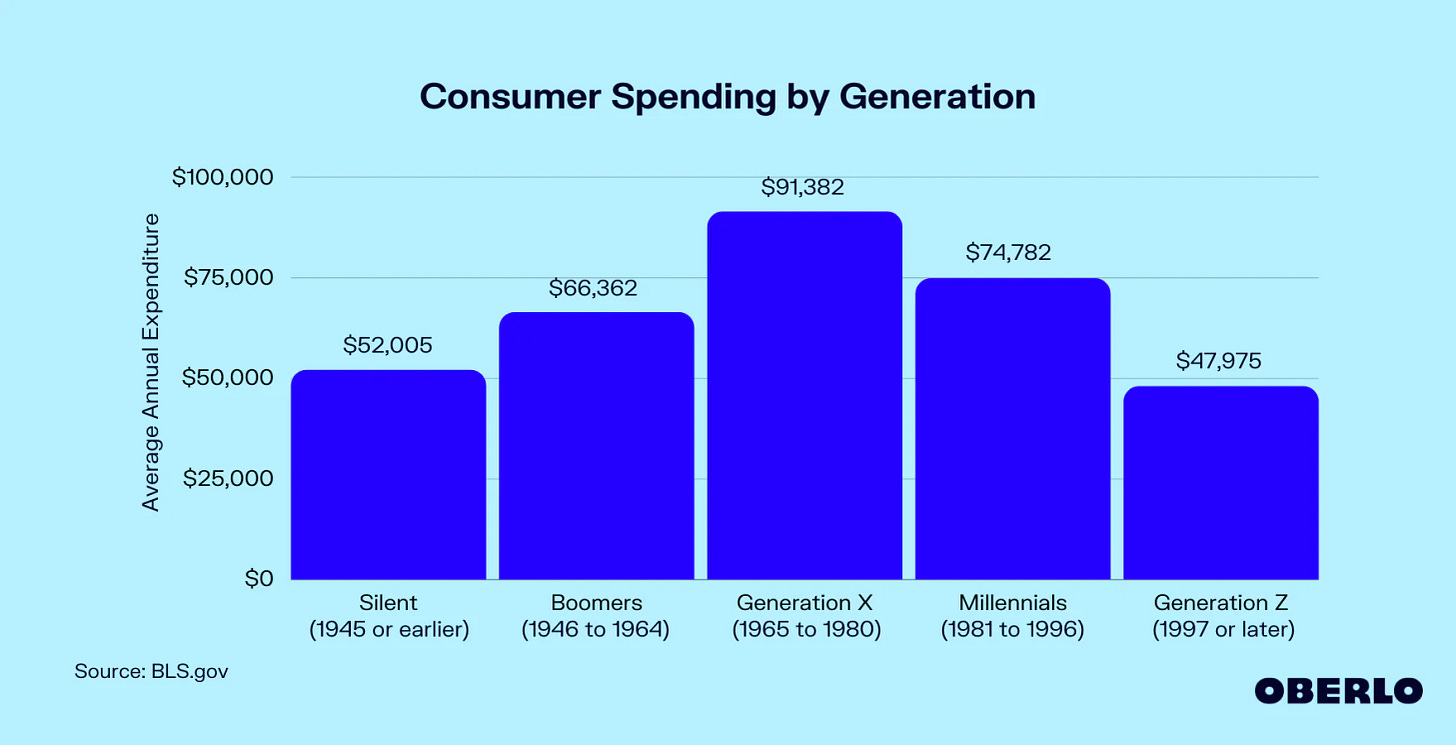

When people enter their prime earning years, typically between the ages of 35 and 55, their income and spending power increase substantially. They simply have a lot more money. For example, men reach their peak earnings at around age 55, while women peak at age 44. This increase in income leads to more spending, which in turn drives corporate profits and stock market performance.

Because think about it; when people make more money, they spend more money. And that money spent turns into profits for another company.

For example, if I buy a new car, that purchase not only benefits the car manufacturer but also the suppliers, dealerships, and service providers associated with that car. The same logic applies to housing. If I buy a home, it not only benefits the real estate agents but also the construction companies, furniture manufacturers, home improvement stores, and various service providers like landscapers and plumbers.

This spending creates a ripple effect throughout the economy, boosting overall economic activity and corporate earnings.

This dynamic is important because the Millennial generation is the largest US generation in history.

The Most Important Generation in US History

Millennials will comprise 75% of the workforce by 2030.

This massive influx of prime earners - which broadly is known as a “secular investing trend” or a long-term market trend driven by demographic shifts - will massively increase spending in the US, which in turn grows corporate earnings and thus stock prices.

In fact, consulting firm McKinsey projects consumer spending will rise by 50% over the next decade as Millennials and Gen Z enter their peak earning and spending years.

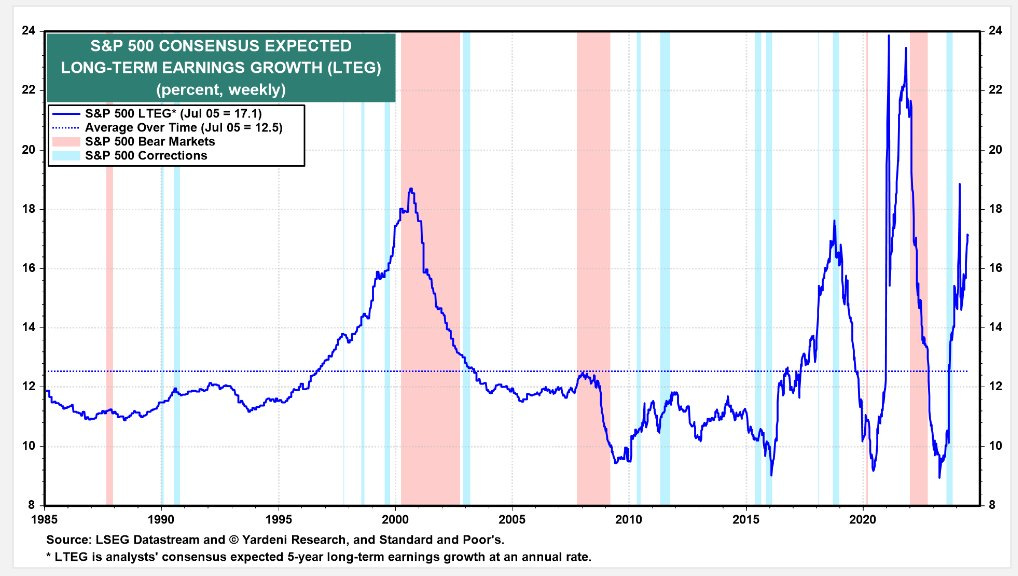

OK, now back to Tom’s forecast. He thinks the S&P 500 can hit 15,000 by 2030. That means during the next six years, spending and thus corporate earnings need to grow a lot. In fact, S&P 500 earnings need to grow ~13% per year for the index to hit 15,000 by 2030.

But is that plausible? Well, the median annual S&P 500 earnings growth over the last thirty years is actually 14.9%, so it’s definitely not out of the question to see S&P 500 earnings grow by 13% per year over the next six years. In fact, the average analyst estimate has the S&P 500 growing +17% annually over the next five years:

It’s also worth noting that it took eight years for the S&P 500 to triple the last time, as the index traded at a mere 1,800 in February 2016.

Considering we’ll have the powerful demographic tailwinds Lee pointed out at our backs, the global labor shortage, and an AI boom, Tom’s forecast is very plausible.

In fact, I’d go as far to say it’s likely. And if my thinking changes, you’ll be the first to know.

Stay safe out there,

Robert