Buy These, Not Those: My Top 4 Picks Right Now

It's important to pick your spots carefully in this market...

I have an exit plan for every scenario.

Over the last few weeks, I’ve laid out why I’m short-term bearish for the first time in two years. My thesis is based on the idea that the Trump administration is front-loading the economic pain and "Volcker-ing" the economy to make the US less dependent on deficit spending.

I've laid this out in newsletters, videos, and podcasts over the last two weeks (click those links if you haven't heard my updated outlook).

But again, I always have an exit plan. Forecasting is more art than science—and I’m always open to changing my mind as the facts evolve. So while further downside in US stocks - and outperformance in defensive and international stocks - remains my base case, we're going to explore my "best case" outlook for markets today.

Because while things look bleak from a near-term fundamental and technical perspective, there are some signs of life for this bull run.

The History of Bull Markets

The bull market in US stocks started in October 2022.

Since then, the S&P 500 has surged 58% higher. While many have claimed this bull run was highly euphoric, that isn't really the case. In fact, if this bull run is truly over - or being intentionally stifled by the Trump administration's policy meant to "reset" the cycle - it would be one of the shortest bull markets ever.

On average, S&P 500 bull markets have returned +192% over the last hundred years.

So if this is the end of the bull run, it would be highly unusual. This supports my view that we will likely see more of a 2018-style correction than a 2022-style bear market.

Historically, the third year of a bull market tends to be the choppiest, with some of the weakest returns:

While all bull runs are different, these indicators show that temporary slowdowns—even sharp ones—don’t necessarily mark the end of a larger trend. In fact, some of the best long-term buying opportunities emerge during these volatile, mid-cycle corrections.

That’s why I’m not abandoning the bull case altogether. If the Trump administration eventually pivots toward pro-growth policies—like tax cuts, deregulation, and increased private-sector incentives—we could see a resurgence in risk assets.

And it's not the only reason for optimism.

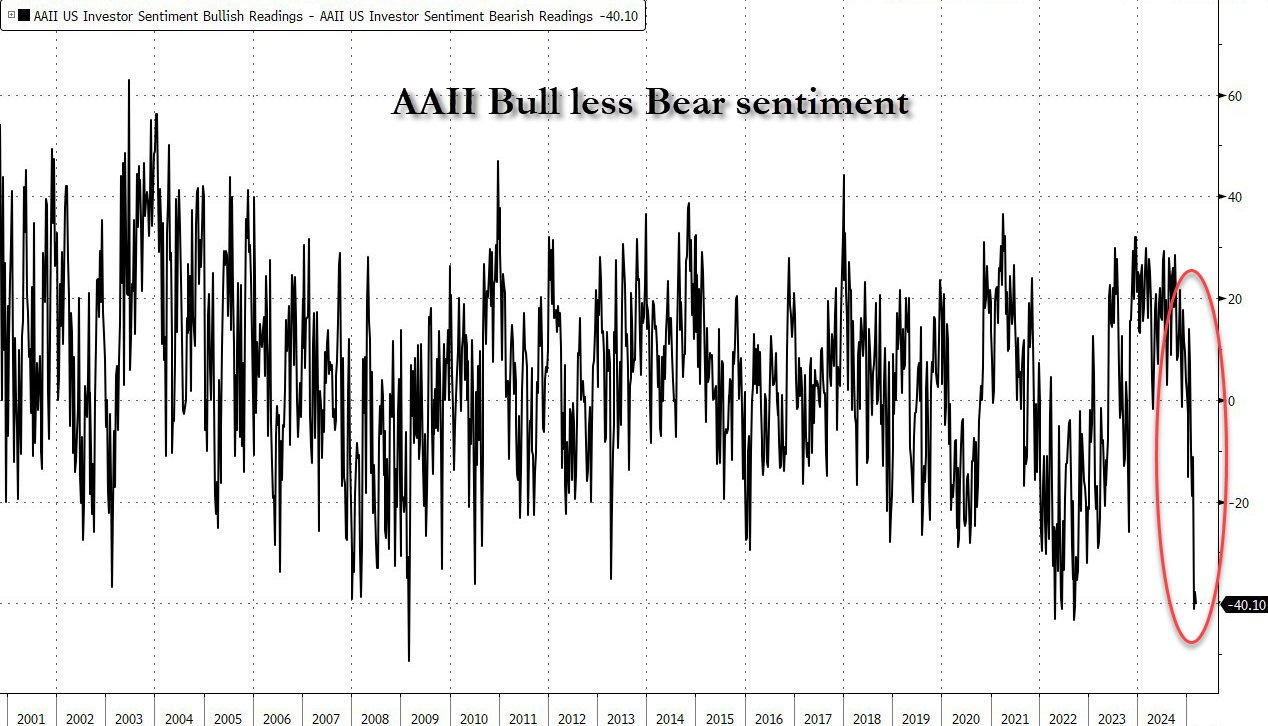

Sentiment Has Rarely Been So Bearish

One of the best contrarian signals is when sentiment hits rock bottom.

And right now, we’re seeing signs that investor pessimism is approaching cycle lows—potentially setting the stage for a contrarian rebound.

For instance, the American Association of Individual Investors (AAII) Sentiment Survey is flashing red. In the latest readings, bearish responses have spiked to levels not seen since the depths of the 2022 sell-off, with only a small minority of respondents expecting stocks to rise over the next six months. Historically, such extreme pessimism has often marked turning points, as fear peaks and selling pressure exhausts itself.

The options market tells a similar story. The put/call ratio—a measure of how many bearish put options are being bought relative to bullish calls—has surged to elevated levels. When traders pile into puts at this pace, it typically signals a crowded bet on further downside, often a prelude to a reversal as the last of the weak hands capitulate.

Other indicators reinforce this gloom. The CNN Fear & Greed Index, which tracks seven different market sentiment gauges, has plummeted into “Extreme Fear” territory. Cash allocations among fund managers, as reported by Bank of America’s latest survey, are near their highest levels in years—a sign that even the pros are hoarding dry powder rather than deploying it.

As the great John Templeton said, "bull markets are born on pessimism, grown on skepticism, mature on optimism, and die on euphoria." And at the very least, we are not seeing any market euphoria at present.

And I have one more reason for you to be optimistic.

The Fundamental Picture is Mixed

As we discussed in this week's podcast (listen on Spotify and Apple Podcasts) investors seem to be misremembering what Trump 1.0 markets were like. Sure, the S&P 500 was up a lot during his presidency. But it was also marked by significant volatility, including a -19% decline in two months and multiple 10% corrections.

Further volatility should be expected. But there are a few good things happening under the surface. For one, President Trump did relent slightly on his reciprocal tariff calls over the weekend:

As we've discussed a few times, his flip-flopping on tariff policy - the main driver of recent volatility - makes this a challenging forecasting environment. Nobody knows what he will say next and there's been little consistency in this administration's messaging.

But I do see some positive signs. For one, key economic indicators like unemployment and industrial production - which hit a record high last print - all point to an economy on decent footing:

That said, you need to pick your spots carefully when deploying capital in this market.

And there are four spots I want to take a stand on with our hefty cash position today.

Four Stocks I'm Buying Today (And Four You Should Avoid)

While I remain cautiously optimistic in the short term, I’m not sitting idle. We're sitting on a large cash pile after taking profits on crypto and select Mag7 names. Here's how I'm redeploying capital into areas showing relative strength.

The first buy on my list is