Before we get started, I wanted to let you know the third episode of my new podcast Room to Run is live on Spotify and Apple Podcasts.

In this week’s episode we discussed:

What stock is the next Nvidia (NVDA)?

Which investing “mega trends” will shape the next decade?

Will the US dollar remain the global reserve currency?

Reaction to Jerome Powell at Jackson hole

My plan for Nvidia (NVDA) earnings

Each 10-minute episode can be listened to for FREE on Spotify and Apple Podcasts. If you enjoy the podcast, please leave a review.

Is the US headed into a recession?

That’s the question on everyone’s mind. And there are some signs that a recession may be on the horizon.

For instance, there is a market indicator known as the “yield curve inversion.” This is when the interest rates on short-term government bonds become higher than the rates on long-term bonds. It means investors are so worried about the near-term economic outlook and are seeking the safety of long-term bonds.

Famed investor Ray Dalio once said, "When the yield curve inverts, it's a sign that the market is pricing in a recession. And when it happens, it's usually a good idea to reduce risk and increase cash." That’s because the “inversion” has happened between 6-24 months before a recession.

But it’s not the only recession indicator flashing red.

The Recession Drum Beat Grows Louder

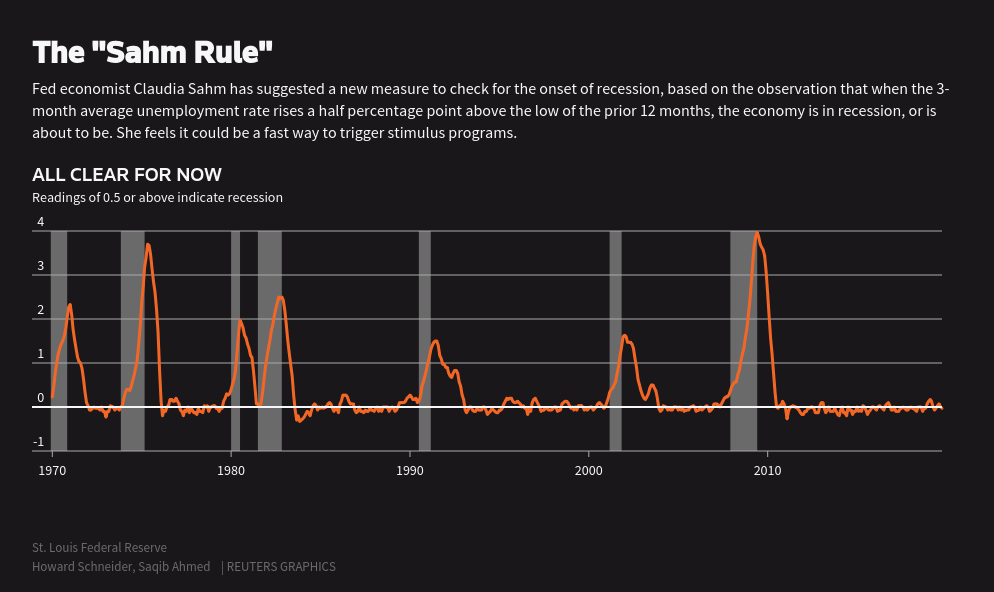

The Sahm Rule was also triggered two weeks ago, which is a reliable recession indicator.

You can think of the Sahm Rule like when your body has a sudden spike in temperature, indicating a fever is coming on and you may be getting sick.

Similarly, the Sahm Rule looks at the U.S. unemployment rate, and when it jumps by 0.5% or more from its recent low, it's a strong signal that the economy might be in trouble. Just like a sudden fever, a quick rise in unemployment is often one of the first signs of an economic downturn.

Jeffrey Gundlach - who manages $91 billion at DoubleLine Capital - once said, “The Sahm Rule is a very reliable indicator of a recession. It's been right every time in the past, and it's a sign that the market is pricing in a recession.”

These are key reasons Goldman Sachs report moved the odds of a US recession from 29% to 41% in two weeks, while the New York Federal Reserve put the odds at 56%.

Since the S&P 500 has declined an average of -29% in ever recession since World War II, this could be a major headwind for the markets.

But does that mean a recession is all but guaranteed?

Climbing the Wall of Worry

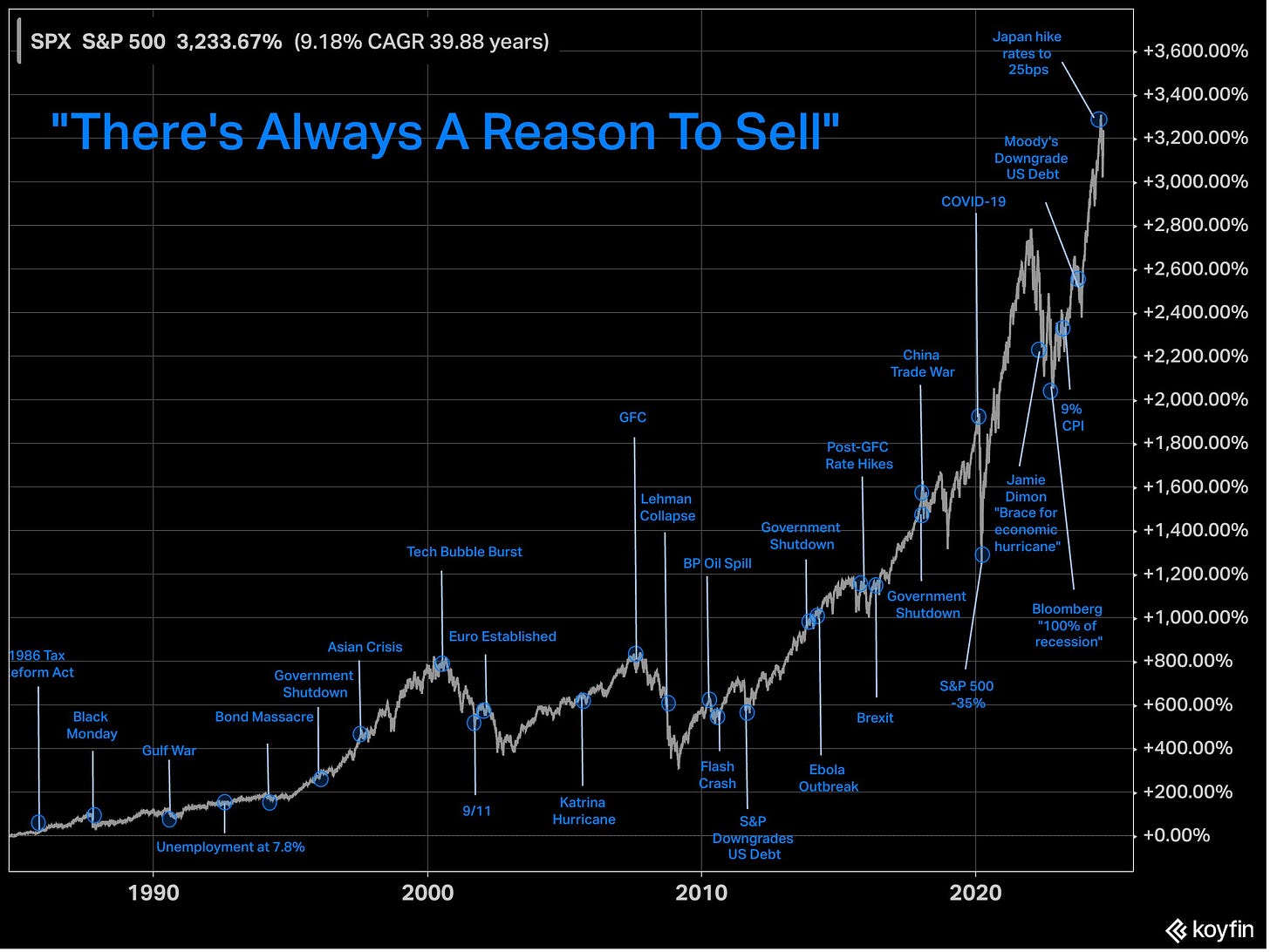

The problem with all the indicators mentioned is the timing.

Yes, the yield curve has inverted before every recession. But it does so with a wide range - 6-24 months - and doesn't tell you how deep or bad the recession will be. If you would've used the original yield curve inversion on July 11th, 2022 as your sell signal, you would've missed out on a +40% rally in the SPX.

So while it may be somewhat reliable for predicting a recession, it’s not very useful for making investment decisions.

As for the Sahm Rule, Claudia Sahm - the PhD economist who invented the rule - recently said that it's likely not reliable thanks to the unusual COVID-era labor market effects.

Plus, the Sahm rule was designed for a decline in labor demand, not a rise in immigration which is the main reason we saw a modest rise in the unemployment rate last report as job cuts are still very low. It has also never signaled a recession from unemployment levels this low, so the rule is likely not a reliable indicator at this point in the cycle.

As for Goldman Sachs and the New York Federal Reserve? Well, Goldman Sachs also predicted a recession in 2023, along with titans of industry like Elon Musk, Jeff Bezos, Jamie Dimon, Mary Barra, and others. And the New York Fed’s Recession model has been signaling recession since mid-2023.

Here’s What I’m Thinking

In my view, recession risk is definitely higher than it was a year ago.

Back then, I was one of the few voices in the investing community stating the US was not in recession. This contrarian opinion is one reason my portfolio finished 2023 +37% (you can view my full portfolio here).

But I'm also of the opinion that forecasting recessions is basically impossible to do consistently, and even more difficult to use such forecasts to make investment decisions. In my career, more money has been lost trying to predict recession by shorting and going to cash than in the recessions themselves.

It’s also important to remember that there are always things to worry about in the market. The 24-hour news cycle will turn a molehill into a mountain to try and grab your attention.

Remember the yen carry trade sell-off from last week when it seemed like the global economy was entering recession? That fear and panic you saw on TV was your buy signal.

While it’s never fun to see your account going down in value, understanding what you own and why you own it can help navigate the constant drumbeat of recession calls and other doom and gloom narratives.

Because the fact is stocks go up most years, climbing a never ending Wall of Worry.

Your goal should be to hold through these spooky periods and - with practice - adding to your positions during sell-offs. This was exactly what I did with my 850+ Patreon Portfolio members near the bottom of the August 5th carry trade “crash.”

So, are we on a brink of recession? Maybe, but nobody is able to predict it.

And even if we do, you should treat it as a buying opportunity.

Stay safe out there,

Robert