Before we get started, I wanted to let you know the new episode of my podcast Room to Run is live on Spotify and Apple Podcasts.

In this week’s episode we discussed:

The three pillars of my investment strategy

What market sentiment is telling us about where stocks head next

How a Strategic Bitcoin Reserve would impact the crypto bull market

Preview of next week’s market moving events

Each 10-minute episode can be listened to for FREE on Spotify and Apple Podcasts. If you enjoy the podcast, please leave a review.

We talk a lot about what makes stocks go up and down.

For years, I’ve said the main driver of stock prices is earnings growth—how much profit a company makes and, more importantly, how much investors expect it to make in the future.

But here’s the thing: stock prices aren’t just tied to numbers. As Stanley Druckenmiller famously said:

“It doesn't matter what a company's earning, what they have earned. You have to visualize the situation 18 months from now, and whatever that is, that's where the price will be, not where it is today.”

It’s all about what is going to happen in the future. And those expectations are shaped by what we investment strategists call narratives, which are the stories that drive investor sentiment and define where capital flows.

And when a narrative shifts - like may be happening with the introduction of a Chinese AI model called DeepSeek - you better shift your portfolio along with it.

A Brief History of Market Narratives

Each decade has been defined by a transformative narrative.

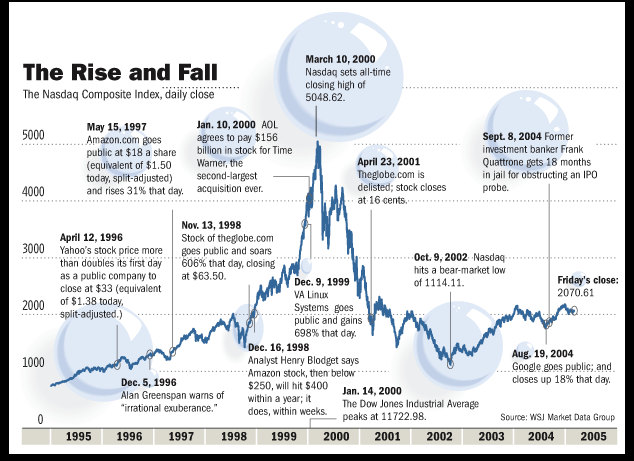

The 1990s were dominated by one transformative narrative: the exponential growth of the internet. This story captivated investors with the promise of a new, interconnected world, sending valuations of tech companies through the roof—whether or not they had any revenue, let alone earnings. Companies like Amazon, Yahoo, and Pets.com became household names overnight.

But as with any narrative, reality eventually caught up. The internet revolution was real, but expectations far outpaced the actual adoption curve. By the early 2000s, the narrative had run its course, culminating in the dot-com bust of 2000–2002.

Many speculative names went bankrupt, but the survivors—Amazon, Google, and others—laid the groundwork for the next cycle.

The 2000s were all about housing and commodities. The housing narrative centered on the belief that real estate prices would always go up, driven by loose lending standards, securitization of mortgages, and a booming construction sector.

Meanwhile, the commodity boom was fueled by China’s rapid industrialization and insatiable demand for oil, metals, and agricultural goods.

Both of these narratives ended disastrously, with the housing bubble burst in 2007, leading to the Global Financial Crisis, and commodity prices collapsed as demand cooled in the early 2010s.

The 2010s ushered in a new narrative: big tech dominance. Investors gravitated toward companies with scalable business models and recurring revenue streams, like the “FAANG” stocks (Facebook, Apple, Amazon, Netflix, and Google):

The rise of mobile computing, cloud services, streaming, and social media amplified this trend, solidifying these companies as the foundation of most portfolios.

But even this narrative began to lose steam in the early 2020s. Rising interest rates, antitrust concerns, and slower growth have challenged the dominance of big tech, forcing investors to explore new stories to guide their portfolios.

That was until October 2022 when OpenAI released a large language model (LLM) called ChatGPT which kicked off a new narrative: artificial intelligence adoption.

And that narrative may be threatened by a new technology out of China.

AI at the Center of It All

The defining narrative of the current bull market has been the rise of artificial intelligence (AI).

Investors have poured billions into companies fueling the AI revolution, with the belief that machine learning, large language models (LLMs), and generative AI will redefine productivity, transform industries, and create unprecedented economic value.

Sam Altman - who founded OpenAI - has even called for investing $7 trillion to meet power demands for AI models:

And much of that capital was meant to acquire GPUs from Nvidia (NVDA), who thus far has provided the backbone of AI infrastructure. Nvidia’s dominance in this space, coupled with the massive capital expenditures (capex) from tech giants building AI capabilities, has propelled it to become the largest company in the world by market capitalization.

And the companies developing their own LLMs - and acquiring $NVDA’s chips to power these models - are a few of the Magnificent 7 tech stocks, particularly Microsoft (MSFT), Meta Platforms (META), and Alphabet (GOOGL). These companies have been some of the best-performing stocks over the last two years, driving much of the bull market’s returns during this period.

In fact, over the last three years, the Magnificent 7 tech stocks—Microsoft, Apple, Amazon, Nvidia, Tesla, Meta, and Alphabet—have driven 60% of the S&P 500’s 29% return, even after a 40% collective decline in 2022.

In the same period, these seven companies accounted for 16% of all sales growth in the S&P 500 and an eye-popping 106% of earnings growth. Their leadership in AI, cloud computing, and other disruptive technologies has positioned them as the engines of the U.S. stock market.

But every narrative has its limits, and the release of a high-performing Chinese LLM potentially developed without the use of Nvidia’s AI chips may be throwing a wrench into this narrative.

What is DeepSeek?

DeepSeek is a newly released large language model (LLM) created by a multi-billion dollar hedge fund based in Hangzhou, China called High-Flyer.

What sets DeepSeek apart from existing AI models like OpenAI's GPT-4 or Google's Bard is its radically low-cost structure. Unlike traditional LLMs that rely on expensive, proprietary GPUs - mostly developed by Nvidia - for training and inference, DeepSeek operates efficiently on much cheaper hardware, thanks to a breakthrough in algorithmic optimization.

Most importantly, it didn’t take billions in investment to create DeepSeek. According to the company, they developed the entire open source model for $8 million. And since the US has an export ban on Nvidia’s high-end AI chips like the H100, DeepSeek may have developed this model without Nvidia’s AI chips.

This would have seemed impossible even last week as DeepSeek’s parent company seems to have built a competitive LLM at a fraction of the cost and resources typically required. If true, this not only lowers barriers to entry for AI adoption but also challenges the foundation of the AI capex cycle—the driver of Nvidia’s meteoric rise.

Firms no longer need to invest billions in AI-specific hardware or cloud computing infrastructure—DeepSeek's lightweight model democratizes AI access. It also directly challenges the "AI capex cycle" narrative that has been the foundation of NVIDIA’s explosive growth and, by extension, the AI bull market.

And this has major implications for the narrative that has driven the bull market over the last two years.

Big Changes Likely Coming to the Market “Leaders”

I have been a major Nvidia bull over the last few years.

While I had owned the stock in the TikStocks Portfolio as far back as April 2021, I have reiterated the stock is a buy multiple times in this free newsletter over the last two years.

Anyone who followed my buy signals has made a lot of money:

But my investment thesis was based on the assumption that we were in the middle of a major AI arms race based around Nvidia’s chips. Companies like Nvidia benefited directly from the enormous capital required to build and maintain AI infrastructure. And now the narrative around that outlook is being challenged by DeepSeek as we may be entering the beginning of a new capital efficient AI cycle.

Now I must note there are some skeptics out there who say DeepSeek’s developers have 50,000 Nvidia H100 chips on which this model was developed. This has been touted both by Elon Musk and Alexandr Wang of Scale AI.

But either way, if AI becomes widely accessible without the need for massive hardware investments, it could weaken the growth story for companies like Nvidia relying on the AI capex cycle. It is also bearish for “model builders” like OpenAI, Perplexity, and Anthropic as DeepSeek is 100% free and open source while those companies use a pay-to-play model.

It also means many Magnificent 7 companies may no longer need to spend $50-$80 billion per year on buying AI hardware, making them much more profitable, growing their earnings, and their stock prices.

My view is we are at the beginning of a major narrative shift. I will send a TikStocks Portfolio update either today or tomorrow showing the exact changes I’m making in my portfolio to reflect this new narrative.

Because the thing with narratives is it doesn’t always matter what happens. It matters what investors think will happen. And judging by Nvidia’s -11% correction this morning, many investors believe DeepSeek shows Nvidia’s chips may not be as integral to the AI revolution as previously thought.

If you want my portfolio changes - including a few sells and buys - to hit your inbox today or tomorrow, you can join the over 1,000 investors who follow my trades every week.

And for everyone else, make sure to keep an eye on this shift.

Because your portfolio depends on it.

Stay safe out there,

Robert