Before we get started, I wanted to let you know the new episode of my podcast Room to Run is live on Spotify and Apple Podcasts.

In this week’s episode we discussed:

Three stocks to take advantage of the “Santa Rally”

What is my highest target price for Bitcoin?

Preview of next week’s market moving events

Each 10-minute episode can be listened to for FREE on Spotify and Apple Podcasts. If you enjoy the podcast, please leave a review.

Is the era of big returns for the S&P 500 over?

Strategists at Goldman Sachs think so, saying in a recent report they expect the S&P 500 to rise a mere 3% per year over the next decade and only 1% when adjusting for inflation, marking a “Lost Decade” for US stocks. This would mark one of the worst decades for stocks since the Great Depression.

And they aren’t alone in this outlook. In fact, Apollo - another top tier firm - forecasted a mere 2.9% growth for the S&P 500 over the next three years.

Even Bank of America only expect the S&P 500 to deliver 1%-2% returns over the next decade.

These forecasts represent a major departure from the gains we’ve seen the last decade as the S&P 500 rose an average of 13% per year over this period and 11% per year over the last 30 years.

So why are these big banks so bearish on US stocks?

The “Lost Decade” Rationale

Goldman Sachs is ringing the alarm bell on the stock market because of its heavy reliance on just a handful of companies, namely the “Magnificent Seven” tech stocks like Apple, Nvidia, and Microsoft.

According to their latest outlook, the market hasn’t been this concentrated in over a century. And that’s a problem, because according to their research team, it’s nearly impossible for a small group of firms to maintain sky-high sales growth and fat profit margins over time.

Apollo cited similar concerns, stating persistent inflationary pressures, a challenging labor market, and ongoing geopolitical tensions as factors that will weigh on corporate earnings and economic expansion.

And Bank of America cited how expensive the market is, stating their Price to Normalized Earnings – the bank’s best predictor of 10-year returns – suggests an annualized price return of just 1-2% over the next decade.

There is some credence to all of these arguments.

But personally, I don’t buy it.

Poking Holes in These Bearish Arguments

I had multiple people message me about these reports.

While I’ve never worked for Goldman, I have headed smaller investment research teams and the first thing I thought of was this is “one guy” or “one team” issuing this report. This is not the opinion of the entire bank.

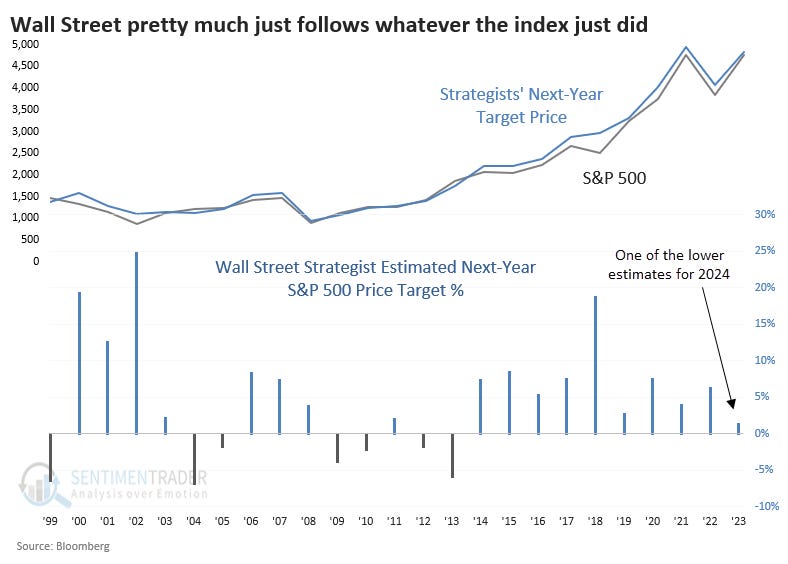

And even if it were, it’s important to remember that big banks get things wrong all the time. If you remember, going into 2024 the average Wall Street investment bank expected the S&P 500 to rise 1% for the year. Instead, the S&P 500 is currently up 27% for the year.

So important to remember that these banks are not infallible, even if they come with a lot of cache like Goldman or Bank of America.

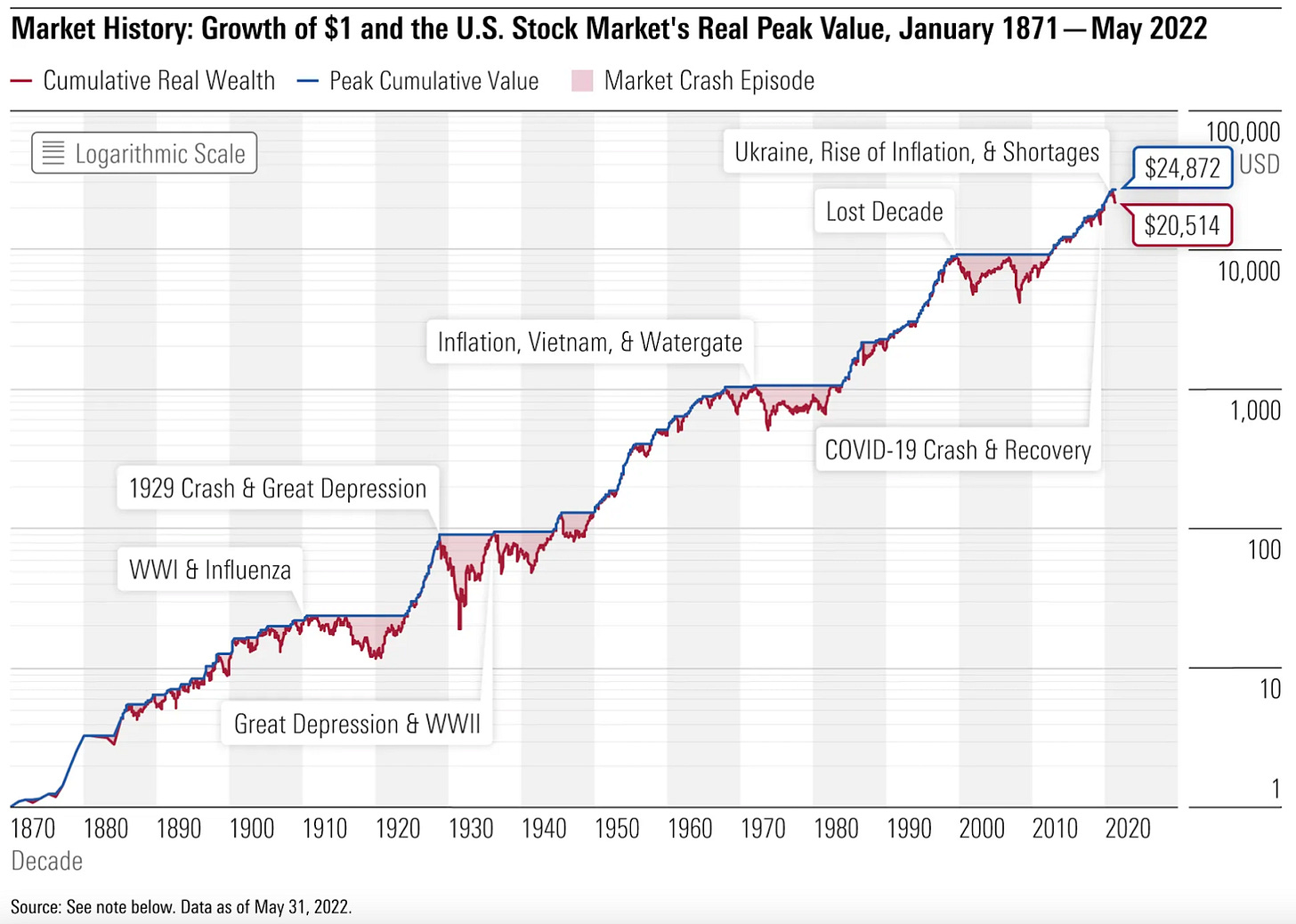

Second, these banks are forecasting a very unusual scenario in the market. The S&P 500 has had weak periods like this twice in history: during the Great Depression and after the 1973-1974 oil shock. While “lost decades” can and have happened, they usually come after a major crisis, not because of the index being concentrated in just a few stocks or because valuations are high.

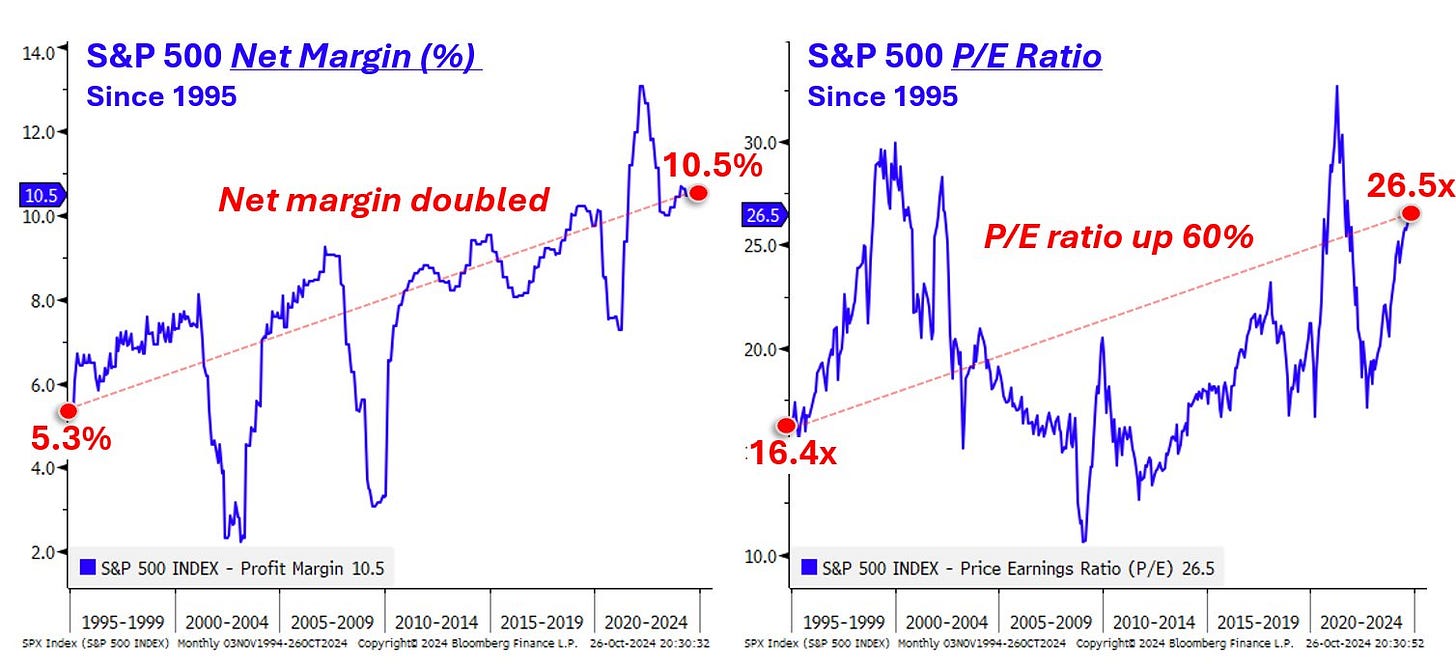

And while these analysts are correct that valuations are high relative to history, there’s an argument that stocks should trade at relatively higher valuations. This is because companies are much more profitable now than ever before.

In fact, businesses have gotten twice as efficient at making money now vs in 1995. To me, that warrants a higher valuation, meaning current market leaders like the Magnificent 7 aren’t as expensive as they appear on the surface.

Keep Your Head on a Swivel

I’m not putting too much stock in these “lost decade” forecasts. Nobody knows for sure what the future holds, but I am not convinced by these arguments.

Instead of worrying about every bearish outlook coming from Wall Street, I’m going to do what I always do: keep buying shares in quality businesses, holding those shares for many years, and letting those gains compound.

That is what me and our 1,000 TikStocks Portfolio members have done for years. And the results speak for themselves, as the TikStocks Portfolio is now up 55% in 2024…

…earning this member enough money to buy himself a personal plane…

…and another who grew his portfolio to over six figures before graduating college:

So, as always, don’t put too much credence into the bearish outlook. Yes, they could be right eventually, but historically it doesn’t make much sense to have a “bearish bias.”

And if my thinking changes on this, you’ll be the first to know.

Stay safe out there,

Robert