Before we get started, I wanted to let you know the new episode of my podcast Room to Run is live on Spotify and Apple Podcasts.

In this week’s episode we discussed:

My outlook after the incredible rally in US stocks

My take on the US government debt downgrade

How to invest in “expensive” and “cheap” stocks like Palantir and Intel

Responding to more hate mail (my new favorite segment!)

Preview of this week's market moving events

Each 10-minute episode can be listened to for FREE on Spotify and Apple Podcasts. If you enjoy the podcast, please leave a review.

The TikStocks Portfolio discord lit up like a Christmas tree on Friday afternoon.

This is pretty rare on a Friday after the market close. But when I saw why, it made more sense as one of the world’s largest ratings agencies downgraded US government debt:

The ratings agency cited ballooning US budget deficits and interest payments as the reason for the downgrade.

But the question everyone in the Discord asked was, “how will this affect stocks?”

Let’s dig into it.

The Downgrade Heard Around... Nowhere?

Late Friday, Moody’s cut the U.S. credit outlook from stable to negative. That might sound subtle, but it’s a big warning shot. It signals that the U.S. is on the verge of losing its last pristine AAA credit rating from a major agency.

For those unfamiliar, there are three big credit ratings firms: S&P, Fitch, and Moody’s.

All three rate the creditworthiness of countries and corporations alike—essentially issuing a letter grade for how trustworthy a borrower is. Think of it like a financial GPA.

In 2011, S&P was the first to downgrade the U.S. from AAA to AA+. It happened during a brutal debt ceiling standoff, and markets freaked out—briefly. Then in 2023, Fitch followed suit, citing long-term fiscal deterioration and political dysfunction.

And now, with this latest move, Moody’s is signaling that it’s preparing to do the same.

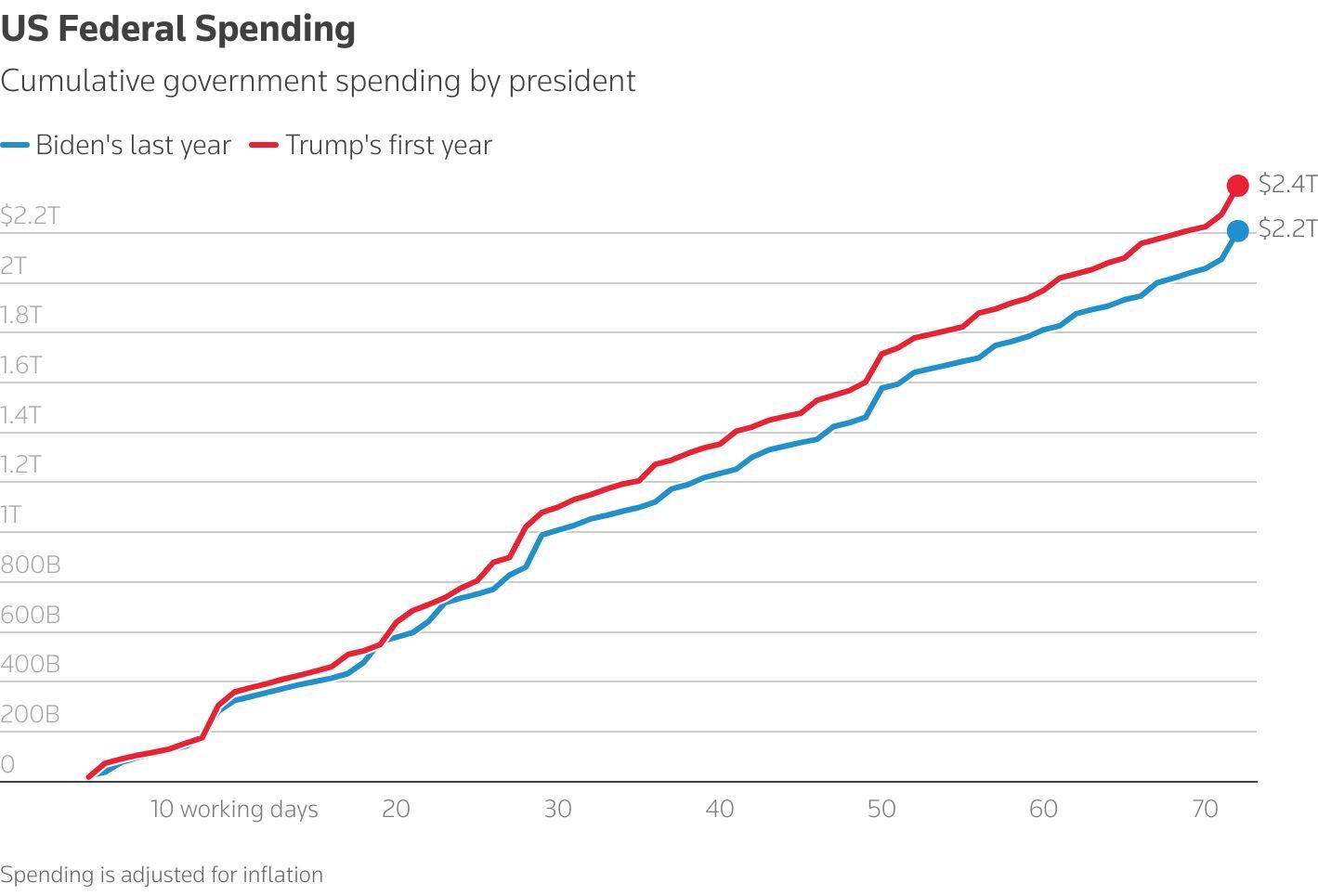

The U.S. government’s financial position has been deteriorating for a while. But the straw that broke the camel’s back may have been the latest Republican tax proposal, which will likely balloon the national debt even further over the next decade.

Of course, this didn’t start with one party; U.S. debt has soared under both Democratic and Republican administrations. We’ve passed tax cuts, spent trillions on COVID stimulus, funded wars, bailed out banks—and now we’re dealing with the cost of higher interest rates on all that debt.

The math is simple but terrifying: the U.S. is on pace to spend more on interest payments than it does on national defense by 2026.

That’s why Moody’s pulled the trigger.

But Here’s the Thing… Everyone Already Knew

Let’s be honest: this downgrade is not some shocking revelation. Anyone who’s been paying attention knows that America’s long-term fiscal outlook is shaky.

The U.S. is running trillion-dollar deficits during economic expansions. That’s not how this is supposed to work. Normally, we’d build up reserves during good times to cushion recessions. But instead, we’ve spent like drunken sailors through multiple administrations—and we now have over $33 trillion in national debt to show for it.

And while I know many people had high hopes for Elon Musk’s Department of Government Efficiency, that has turned out to be more political theater than anything.

So while the Moody’s downgrade sounds dramatic, it’s really just an official stamp on what the bond market has been saying all year.

What Happened in 2011?

Let’s go back to the last time this happened—August 2011—when S&P downgraded the U.S. for the first time in history.

The headlines were apocalyptic.

And then?

The S&P 500 dropped -17% in the following weeks... and then went on to rally over 250% over the next five years.

The situation was also far different in 2011. Back then, the US economy was only a few years removed from the Great Recession - the worst economic crisis since the Great Depression. And at the time, many institutions had contracts, loan agreements, and other directives stating they could not invest in non-AAA rated assets. Some thought this meant institutional investors would have to stop buying US Treasuries or - in a worst case scenario - need to sell.

However, in years since, those contracts have removed such clauses. And even though 2011 saw a swift pullback in US stocks, it was temporary. That’s because markets don’t price based on surprise. They price based on expectations.

Once the panic passed, investors realized the downgrade didn’t actually change the U.S. government’s ability to pay its bills. The dollar didn’t collapse. The U.S. Treasury market remained the deepest and most liquid in the world.

Same situation here. Although there is another elephant in the room investors need to watch directly tied to this downgrade.

What About This Time?

The S&P 500 has rallied hard over the last month—up over 20% from the April lows. That’s partly due to Donald Trump walking back his most aggressive tariff plans. But here's the catch: bond yields haven't come down.

That’s a problem.

Why? Because bond yields are what drive the cost of capital. Higher Treasury yields = higher mortgage rates, higher credit card rates, higher auto loan rates—and higher costs for businesses to borrow and invest.

And right now, even with stocks rallying, the 10-year Treasury yield is still hovering near 4.5%. That means the U.S. government still has to roll over $9 trillion in debt at much higher interest rates. That pressure is not going away.

So while the downgrade isn’t a vote of confidence, the real elephant in the room is sky high bond yields. That is the issue you should be worried about, not what a ratings agency is telling you.

This downgrade is a symptom—not a cause—of deeper fiscal imbalances that have been building for decades. Moody’s just happened to be the last of the Big Three to say the quiet part out loud.

The market already knows the U.S. isn’t running a sustainable balance sheet. But until there’s a true alternative to the dollar and the Treasury market, this downgrade will remain more symbolic than structural.

That said, watch bond yields closely. If the 10-year starts heading toward 5% again, things could get rocky for stocks. But if yields stay steady or drift lower—and inflation remains tame—this market can grind higher.

For now, stay nimble, stay diversified, and don’t let headlines scare you out of long-term thinking.

Stay safe out there,

Robert