Adding to Two Positions Today

How to profit from the longshoreman strike, Chinese stock boom, and more...

They could never make me hate this bull market.

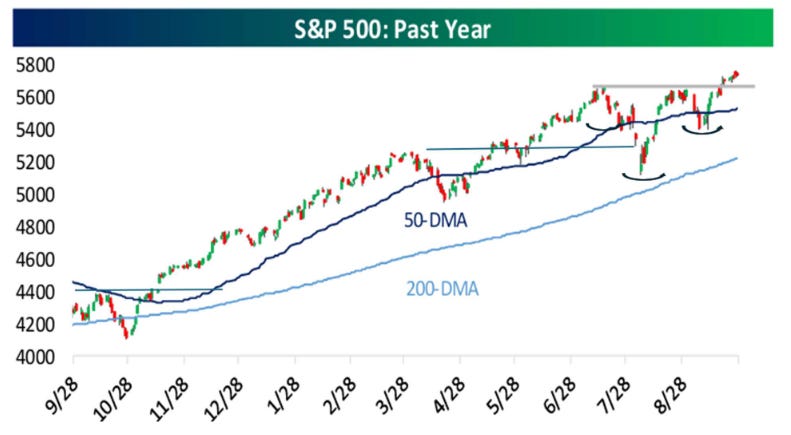

So many misguided analysts on mainstream networks and social media tried to scare you out of the market in the last year. They'd talk about yield curve inversions, yen carry trades, wars in the Middle East, Kamala Crashes, AI bubbles, SAHM Rules, employment figure revisions, Nancy Pelosi's trades, insider selling, and a host of other meaningless catalysts for a stock market crash.

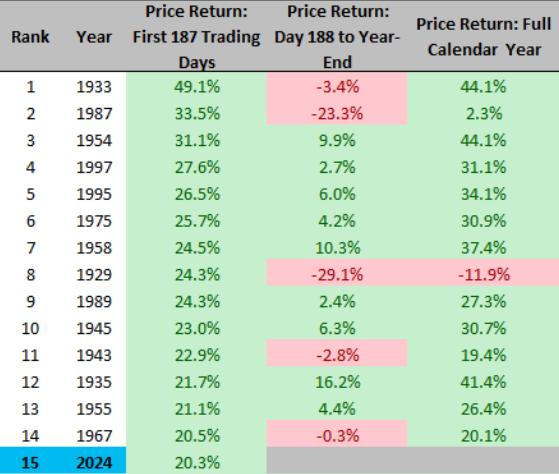

Yet instead, the S&P 500 is +20% this year and is having its best year since 1997...

...and I don't expect the fun to stop any time soon for a few reasons.

The Goldilocks Phase Persists

I've been saying for over a year about how US stocks are in their "goldilocks" phase.

This means that we have the following market conditions:

Falling and stable inflation

Slow but steady economic growth

A Federal Reserve who's easing monetary policy

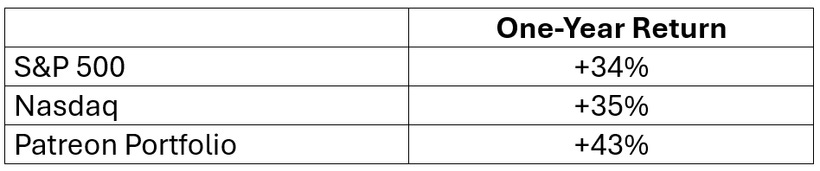

This setup has been clear to me since October 2023. And we've made a lot of money ignoring bearish narratives and investing around this theme as the Patreon Portfolio is +43% in the last year:

That's ahead of the S&P 500 and Nasdaq over the same holding period:

As I made the case for last month, I believe markets are still in the Recovery phase of the economic cycle. That means the "Boom" or "Overheat" phase hasn't happened yet:

This outlook is supported by the massive uptick in global liquidity.

The Global Liquidity Boom Continues

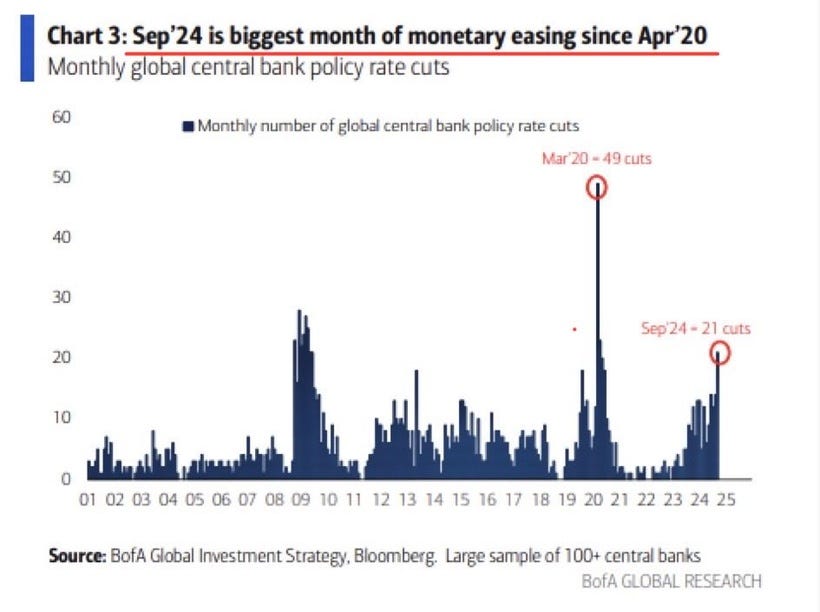

Last year we noted October 2022 was the first month without a rate hike since late 2020.

And the pendulum is now swinging the other way. Governments around the world are now turning on the money printers, as September had the largest monetary easing since March 2020:

The latest chapter in this global liquidity boom came last week when the Chinese government announced a massive stimulus package aimed at boosting economic growth and stabilizing financial markets

The People's Bank of China unveiled plans to inject over 1 trillion yuan (approximately $140 billion) into the economy by cutting banks' reserve requirement ratios, targeted lending facilities, and open market operations.

This caused the Shanghai Composite Index to surge from a 52-week low to a 52-week high in five days:

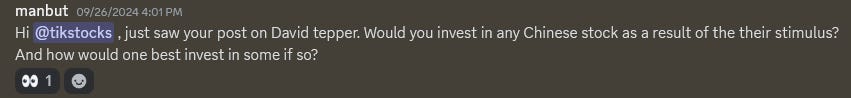

This naturally led to a lot of questions like this from our Discord community:

We've avoided Chinese stocks since we sold our Alibaba (BABA) position in December 2020. This was the right move, as the stock is down -58% since we sold even after the latest rally:

The latest rally in Chinese stocks is unprecedented. And previous stimulus efforts from the Chinese government have lead to major rallies in Chinese stocks:

We could be at the beginning of a fourth major stimulus rally. However, I would not invest in any Chinese stocks for the long-term. There is simply too much political risk and negative demographic trends for me to get too excited.

However, buying Chinese stocks for a trade in the Speculative Portfolio with a small amount of cash is likely in the cards. I am always open to changing my mind and remain flexible in my thinking, so even though I've been publicly bearish Chinese stocks for years it doesn't mean I won't trade them.

That said, in the near-term I am not trying to chase Chinese stocks as they are overbought on every metric. And much like oil stocks in 2022 when everyone thought "this time is different," this latest stimulus-driven rally could be short-lived as China has major economic issues that won't be solved by an $140 billion liquidity injection.

So for now, I will wait on the sidelines to enter a Chinese stock trade. But a few vehicles to play this trend on my radar include direct Chinese stock investments into an index like iShares China Large-Cap ETF (FXI) to reduce single stock risk. That's in addition to a tangential play on a Chinese economic resurgence via a position in LVMH Moet Hennessy Louis Vuitton (LVMUY) which generates a significant amount of sales in China (and we've made money in it before).

But there are a few portfolio moves independent of Chinese stocks I plan to make today.

Upgrading Two Portfolio Positions

The S&P 500 has hit 42 new all-time highs in 2024.

The median US stock is now making new all-time highs, with 82% of US stocks trading above their 200-day MA. And when you consider the S&P 500 just broke about above a "double top" pattern, I would be shocked if US stocks aren't much higher six months from now.

For that reason, we are upgrading a few positions today…